Listen to this blog

Insurers today are feeling the heat. Customers expect faster, smarter, more connected experiences, and the industry is moving quickly to keep up. But many carriers are still working with decades-old systems that are tough to change and costly to maintain. 58 percent of insurance industry survey respondents admit their tech foundations aren’t where they need to be.

The good news is that nearly 70% of insurance tech leaders plan to ramp up modernization efforts. The challenge now is figuring out how to modernize without disrupting the business, and that’s exactly what this blog will explore.

What makes legacy systems so hard to move away from?

Most core insurance systems were designed for reliability, not agility. Over the years, they’ve become rigid and difficult to manage. Business rules are deeply embedded, data sits in silos, and even small changes can lead to major complications. The result is rising costs and slower business performance.

Legacy systems limit flexibility, increase maintenance costs, and lack the integration needed for modern technologies. Underwriting takes longer, launching new products becomes harder, and staying compliant is more expensive.

Yet, for many large insurers, replacing everything at once is simply not feasible. What insurers need is a phased, low-risk approach to modernization that improves agility without stalling progress.

What is the smarter way to modernize legacy insurance systems?

The answer lies in moving forward with structure, control, and minimal disruption.

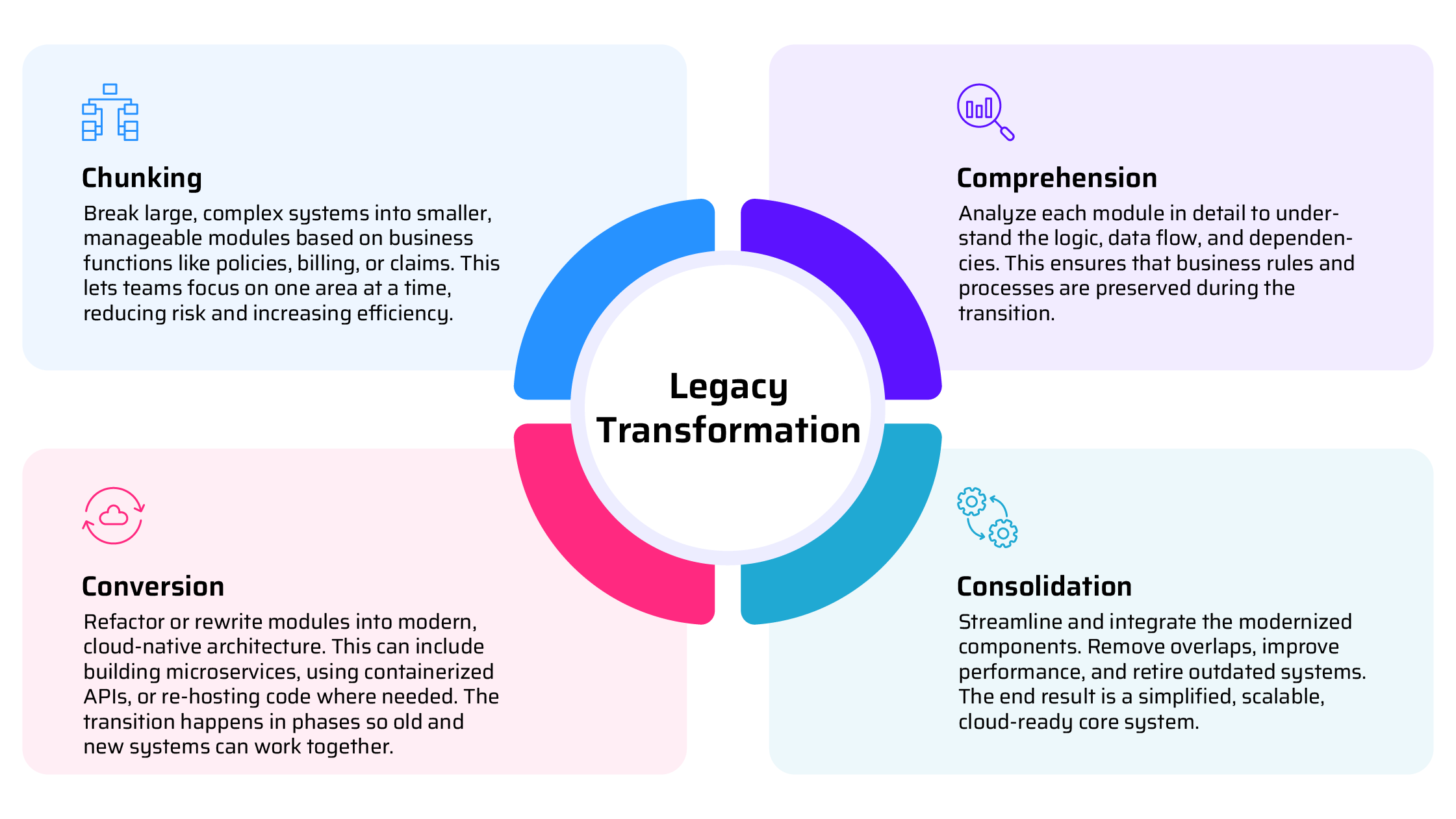

Visionet’s Legacy Modernization Accelerator gives insurers a clear and practical way forward. Instead of attempting a massive, high-risk overhaul, the framework breaks modernization into four focused phases. This structured approach helps insurers tackle legacy transformation without disrupting daily operations, while maintaining full control at each step.

The four phases are:

This phased model mirrors industry best practices and is tailored for insurers who need to modernize with minimal disruption. It offers a smarter, lower-risk path to future-ready technology.

What outcomes can insurers expect with this approach?

Using Visionet’s phased modernization framework, insurers unlock real business value:

- Reduced risk of disruption: By breaking transformation into smaller, manageable phases, insurers avoid the pitfalls of a high-risk overhaul. Systems stay operational, and each step is carefully controlled.

- Faster transformation: Parallel workstreams and agile execution accelerate delivery. Insurers can launch new workflows, products, and services faster, without waiting for an entire system overhaul.

- Lower costs and higher ROI: A phased approach avoids the massive costs of a full replacement. Cloud adoption reduces maintenance expenses, and reusing existing logic and data boosts the return on earlier investments.

- Future-ready foundation: The result is a modern, scalable core system designed to support APIs, real-time data, and emerging technologies like AI and analytics.

Overall, insurers gain a more flexible, resilient foundation that fuels innovation, without the disruption. It’s a smarter path to modernization that delivers real, ongoing business value.

Thinking about starting your modernization journey?

Legacy modernization doesn’t have to be a leap into the unknown. With the right partner and a structured plan, insurers can move forward with clarity and confidence. Visionet’s modernization accelerator is built to support your journey step by step, helping you unlock long-term value while staying focused on your business and your customers.

Want to talk about how this could work for you? Reach out to us. We are here to help.