Listen to this blog

Introduction

In the mortgage industry, efficiency and accuracy are paramount for achieving a seamless loan origination and closure process. As the volume of loan applications continues to rise and regulatory demands become increasingly complex, lenders face a growing set of challenges—particularly in managing documentation and maintaining compliance with key industry standards, such as the Uniform Closing Dataset (UCD) and Uniform Loan Application Dataset (ULAD).

Many lenders continue to rely on outdated legacy platforms, resulting in inefficiencies, higher costs, and extended loan processing times. These challenges underscore the critical need for scalable mortgage processing solutions that leverage advanced technology to optimize workflows, shorten turnaround times, and ensure seamless regulatory compliance.

This article highlights how adopting GenAI solutions can boost operational efficiency, improve customer satisfaction, and drive success in a competitive mortgage lending market.

Challenges Faced by Mortgage Lenders

Managing large volumes of documentation for mortgage processing is a major challenge for lenders. Each loan involves meticulous document scanning, verification, and processing. Missing or incorrect paperwork can lead to costly delays, wasting both time, compliance issues, and money. To add, mortgage lenders must navigate the ever-changing regulatory requirements. Failure to stay compliant can result in penalties and damage to a lender's reputation, further complicating the process.

How Scalable Mortgage Processing Solutions Overcome These Challenges

Take, for example, one of our clients—midsized mortgage lender— was struggling with a legacy document processing system. The mortgage processing team often faced bottlenecks, particularly during peak seasons, slowing down the entire loan application process. These delays not only frustrated their team but also impacted customer satisfaction.

By implementing our advanced mortgage processing solutions, which included Intelligent Document Processing (IDP) and automated compliance checks, the lender was able to streamline operations and reduce processing times by 30%. This increased speed and accuracy allowed them to process more loans without adding to their workforce, resulting in greater efficiency and improved customer satisfaction.

Leveraging scalable, technology-driven solutions like these enables mortgage lenders to stay competitive, improve operational efficiency, and maintain compliance—all while enhancing the customer experience.

01. Reducing Turnaround Time (TAT)

Mortgage lenders need to close loans quickly while ensuring accuracy. Scalable mortgage processing solutions, powered by automation, help reduce turnaround time (TAT) by streamlining key tasks like title checks, document verification, and data validation. This not only speeds up the loan approval process but also improves overall operational efficiency.

02. Error Detection

Managing the large volume of documentation required for mortgage processing is a significant challenge for lenders. Each loan application involves detailed document scanning, verification, and processing. If not handled efficiently, these tasks can lead to delays in loan approval and processing times. Additionally, missing or inaccurate documents can disrupt the mortgage process, potentially causing costly errors, compliance issues, and further delays. Implementing efficient document management systems is crucial to reducing processing time and ensuring accuracy in mortgage lending.

03. Ensuring Compliance with Mortgage Regulations

Compliance with ever-changing regulations is a critical aspect of the mortgage lending industry. Lenders must stay up to date with evolving regulatory requirements to avoid potential risks. Failing to comply with these regulations can result in severe penalties, legal complications, and significant damage to a lender's reputation. Implementing automated compliance checks and staying informed about industry standards is essential for mitigating these risks and maintaining a smooth, legally compliant mortgage process.

The Importance of Integrating Technology into Mortgage Processing for Efficiency and Accuracy

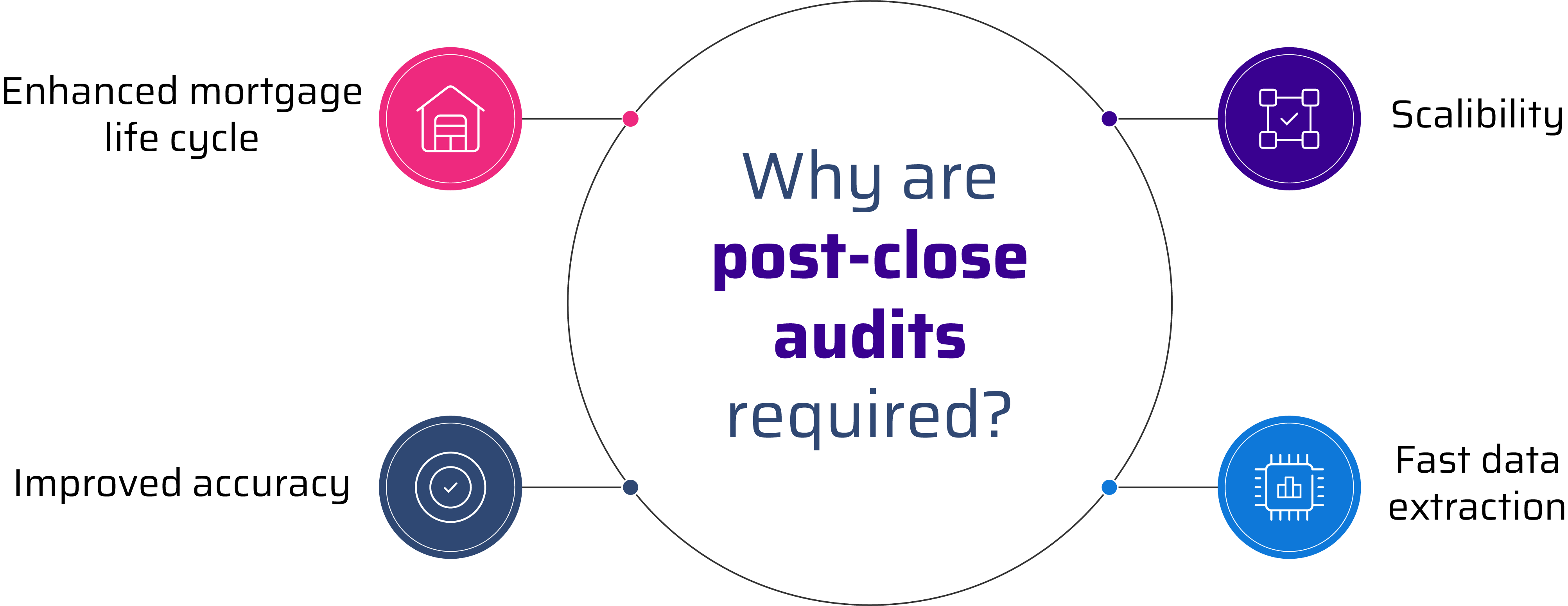

01. Streamlined Mortgage Lifecycle

Automation enhances every stage of the mortgage process, minimizing manual errors and accelerating loan approvals. With automated workflows, lenders can efficiently manage a higher volume of applications without sacrificing quality or accuracy.

Example: A midsized lender boosted processing capacity by 30% after implementing automated workflows, significantly improving efficiency and turnaround times.

02. Scalability

Scalable mortgage processing systems empower lenders to adapt to changing demand without the need for additional staff. Automation makes it easy to quickly adjust operations to manage higher loan volumes, all while maintaining exceptional service quality.

Example: A lender successfully scaled operations during peak periods, processing 20% more loans without the need to hire extra staff.

03. Enhanced accuracy in mortgage processing

Automation plays a crucial role in reducing human errors in data entry and verification, ensuring that all information is accurate and compliant with industry regulations. By minimizing mistakes, automation leads to faster loan approvals and more reliable data handling.

Example: A national lender improved accuracy by 35% after implementing automated compliance checks and data verification tools, significantly reducing errors.

04. Faster data extraction with Intelligent Document Processing (IDP)

Intelligent Document Processing (IDP) automates the extraction of critical data from loan documents, streamlining the processing workflow and reducing manual effort. This technology accelerates the loan approval process and enhances operational efficiency.

Example: A client reduced data extraction time by 40% using IDP, resulting in quicker loan approvals and faster processing.

Conclusion

By adopting scalable, technology-driven mortgage processing solutions, lenders can significantly improve operational efficiency while delivering an enhanced experience to their clients. These solutions reduce turnaround times, ensure regulatory compliance, and easily scale with growing demands. In today’s highly competitive mortgage market, embracing innovation is essential to stay ahead, reduce costs, and achieve faster loan closures.

Embrace innovation today and streamline your mortgage processing. Discover how scalable, technology-driven solutions can enhance efficiency, ensure compliance, and accelerate loan closures. Contact us to learn more and stay ahead in the competitive mortgage market.