Your strategic mortgage partner

Powered by AI, driven by expertise and backed by comprehensive licensing

Simplifying complexity. Accelerating success. Ensuring compliance.

Request a meeting

Visionet Mortgage Solutions

Navigating the mortgage process can be overwhelming—regulatory hurdles, market fluctuations, and

operational inefficiencies create unnecessary delays and risks. That’s why you need more than just a

service provider—you need a strategic partner who understands the industry inside out and delivers AI-

powered mortgage solutions designed for speed, accuracy, and compliance.

We bring together advanced AI/ML-backed platforms, robust workflow automation, and deep industry

expertise to help lenders, financial institutions, and investors streamline operations, manage risk, and stay

compliant—without compromising on speed or efficiency.

Why partner

with us

Strategic expertise meets cutting-edge technology, built for scale

Our mortgage experts blend AI/ML technology with decades of experience to deliver trusted guidance and powerful solutions. DocVu.AI is an AI-driven platform that transforms data into insights, ensuring precision in document processing, validation, and discrepancy detection, while automating underwriting for improved efficiency.

Regulatory compliance & licensing you can trust

We hold necessary licenses and adhere to all federal and state compliance requirements, ensuring every mortgage transaction meets the highest regulatory standards.

End-to-end mortgage solutions, customized for you

Whether you're a lender, servicer, or investor, our comprehensive solutions cover the entire mortgage lifecycle — From origination to post-closing, servicing performing and default loans, REO asset management and secondary market — tailored to your unique needs.

Stronger risk management & smarter decision-making

Real-time analytics, predictive modeling, and automated compliance checks ensure proactive risk mitigation, minimizing loan defects and improving loan quality.

Maximizing operational strength & efficiency

By integrating intelligent automation, real-time data analytics, blend of domain experts with AI-driven automation and workflow, we help you optimize every stage of the mortgage lifecycle. Our streamlined workflows reduce processing times, minimize costs, and enhance loan quality, ensuring faster approvals, lower default risks, and improved borrower experiences. Whether it’s loan origination, underwriting, due- diligence, servicing, or portfolio management, our solutions, backed by licenses, drive operational excellence—so you can focus on growth, profitability, and delivering exceptional customer value.

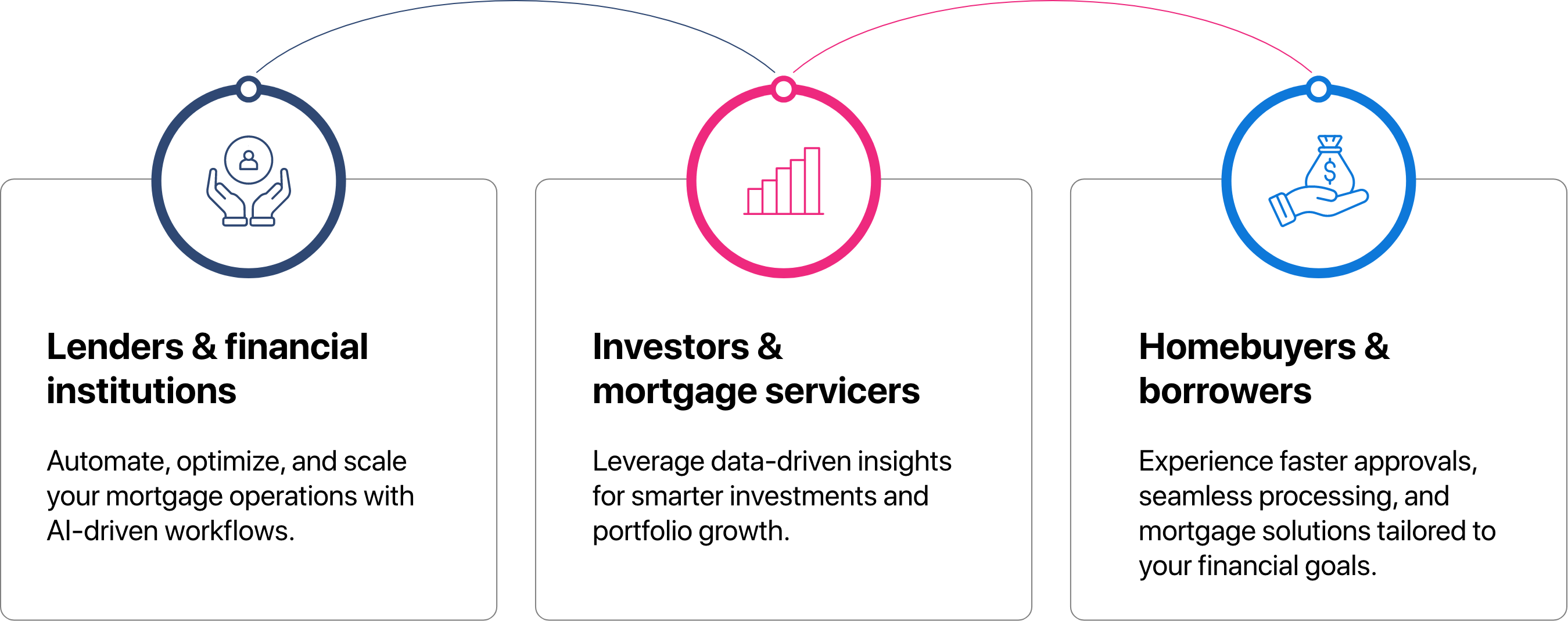

Who we empower

Let’s build the future of mortgages—Together.

Partner with the future of mortgages:

Visionet Mortgage Solutions –

NMLS ID # 2670651

Success in today’s mortgage industry requires speed, accuracy, and compliance—we deliver all three with an AI-driven approach that keeps you ahead of the curve.

Locations

4 Cedarbrook Drive, Bldg. B,

Cranbury, NJ 08512

609-452-0700

111 Technology Drive,

Pittsburgh PA 15275

+1 412 927 0226

Visionet Systems,

AMR Tech Park,

Ground Floor, #23 & 24,

Hosur Main Road, Bengaluru

Karnataka,

560 068, India

+91 806 669 0000

Visionet Systems,

#105 Tidel Park,

1st Floor, IT-SEZ Villankurichi,

Coimbatore, Tamil Nadu, India

+91 422 610 5000

Contact Us

Take the First Step with Us

Ready to accelerate your business with cutting-edge technologies? Fill out the form, and our experts will reach out to you.