Listen to this blog

In an industry where timing and trust make or break customer relationships, claims management has become the focal point of digital transformation in insurance. Yet, despite mounting pressure to modernize, many insurers are still stuck with fragmented systems, manual handoffs, and reactive fraud detection. It’s no longer enough to just 'process' claims, what’s needed is intelligent, scalable automation.

This is where Visionet’s Claims Assist Accelerator steps in. Purpose-built to reimagine claims handling from intake to settlement, it harnesses AI to streamline every step, reduce operating costs, and elevate customer experience.

Let’s take a deeper look at why it matters and how it works.

The broken state of traditional claims handling

Manual claims processing is slow, error-prone, and expensive. Every delay, inconsistency, or missed fraud signal creates friction and erodes trust. According to Forrester, nearly 70% of IT budgets in insurance are consumed by maintaining legacy systems, leaving little room for innovation or improving customer experience.

Other pain points include:

- Slow cycle times frustrate customers and increase churn risk

- High operational expenses due to manual data entry, approvals, and follow-ups

- Fraud vulnerabilities, with global insurance fraud topping $80 billion annually

- Inconsistent decisions from over-reliance on human discretion

Enter Claims Assist: A smarter way to handle claims

McKinsey estimates that up to 50% of current claims activities can be automated with today’s technology. Understanding this urgent need for intelligent, scalable solutions that can handle this shift, Visionet’s Claims Assist Accelerator is designed to address the aforementioned pain points with AI-powered precision and automation.

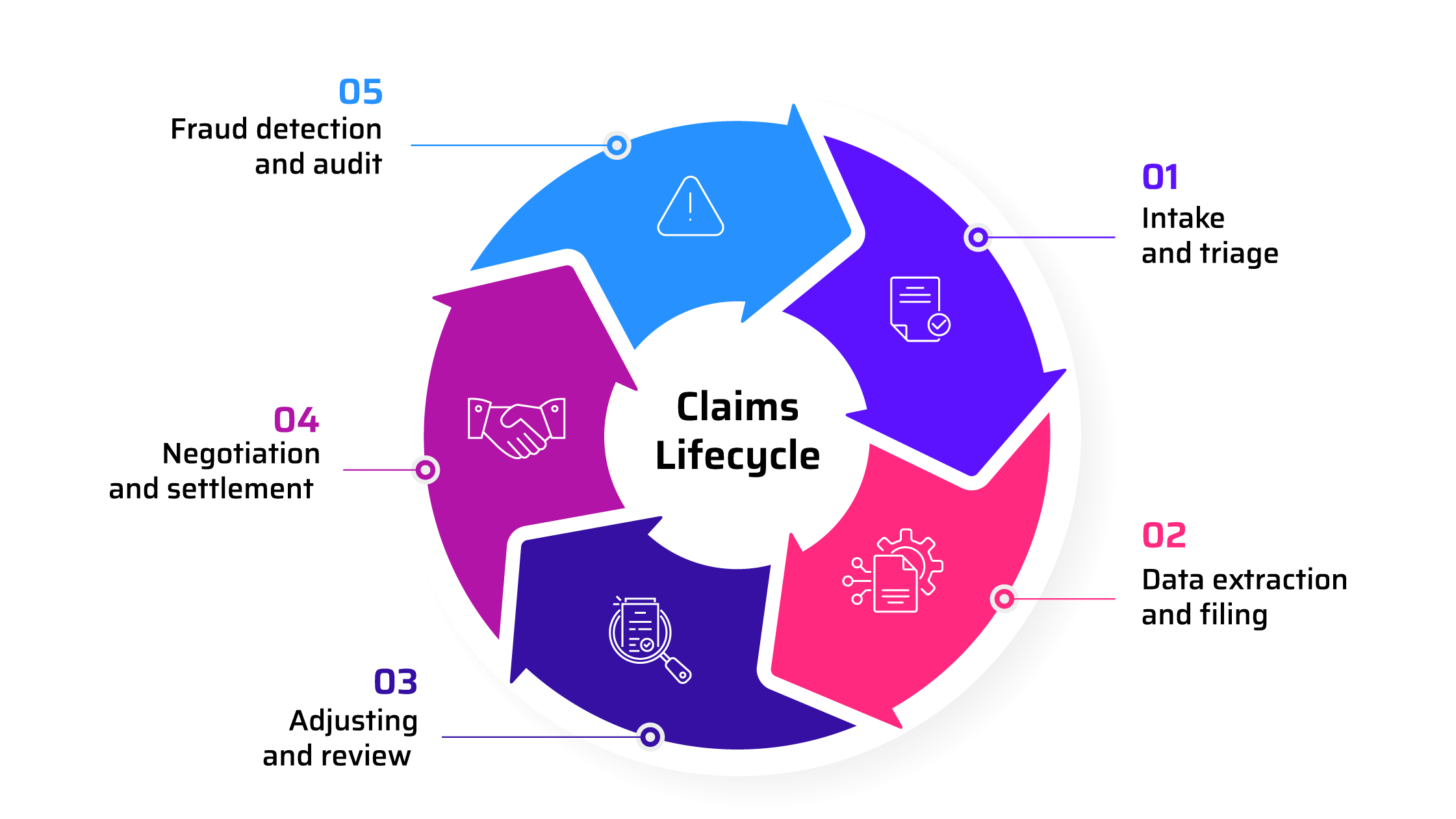

At its core, Claims Assist re-engineers four critical moments in the claims journey, each optimized for speed, accuracy, and control:

1. AI-driven claim triage

The moment a claim is submitted, the accelerator kicks in. Using natural language processing (NLP) and machine learning, it rapidly:

- Validates claim information

- Assesses severity

- Prioritizes based on complexity and urgency

This enables faster routing, ensuring simple claims are fast-tracked while complex ones get immediate human attention.

2. Automated filing and adjusting

Gone are the days of hand-entering details from PDFs or email threads. Claims Assist intelligently extracts structured data from unstructured sources like policy documents, claim forms, and even images, eliminating redundant manual work and ensuring policy rules are applied correctly.

3. Negotiation support with AI insights

For adjusters handling negotiations, the system offers decision support with suggested ranges based on past claims, regional data, and real-time policy insights. This accelerates fair settlements and reduces back-and-forth.

4. Proactive fraud detection

Using predictive analytics and behavioral patterns, the accelerator flags suspicious claims upfront before they enter payment processing. It continuously learns from each interaction, improving accuracy over time.

Claims Assist touchpoints across the claims lifecycle

Business benefits you can count on

Backed by a solution tailored to scale in real-world conditions, insurers can aim for the following business outcomes with Claims Assist:

- Shorter claim cycle times - Claims are processed faster, freeing up resources and improving customer response times.

- Reduced operational costs - With routine tasks automated, your team focuses only on exceptions and complex cases, leading to significant savings.

- Stronger fraud controls - Proactive fraud detection helps reduce losses, avoid false payouts, and protect customer trust.

- Improved accuracy and compliance - Policy rules are consistently applied, and decision-making is more transparent, lowering rework and disputes.

- Better customer experience - Fast answers, fewer errors, and consistent treatment lead to happier policyholders and better retention.

Built to work with what you have

Visionet understands that no two insurers have the same stack or workflows. That’s why Claims Assist is modular, API-ready, and system-agnostic. It can plug into existing claims platforms, core systems, and data warehouses without requiring a rip-and-replace approach.

And unlike off-the-shelf solutions, Visionet works with clients to tailor rules, models, and automation levels based on their business priorities and risk appetite. You can start small and scale up over time as confidence and ROI grow.

The bottom line

Claims are where customer loyalty is tested, and margins are made or lost. With rising expectations, increasing fraud, and shrinking room for error, transforming claims has become a business imperative.

Visionet’s Claims Assist Accelerator delivers real, scalable impact. It accelerates your claims operation without sacrificing accuracy or oversight. No matter the size of your claims portfolio, this solution offers the precision, speed, and intelligence needed to stay competitive in a fast-evolving insurance landscape.

Contact us. It’s time to move beyond processing and start performing.