Listen to this blog

Introduction

Imagine trying to solve a puzzle with missing pieces and mismatched shapes, that’s what accounts reconciliation feels like for many finance teams today. The sheer volume of transactions, coupled with fragmented systems and manual processes, creates an environment ripe for errors and inefficiencies. Beyond the operational headaches, these challenges can lead to compliance risks, delayed decision-making, and missed opportunities for strategic growth. But here’s the silver lining: with the right strategies, reconciliation can evolve from a routine chore to a streamlined, high-value process. This blog explores six targeted steps to bring clarity to complexity, empowering finance professionals to achieve accuracy, efficiency, and actionable insights.

How can organizations align compliance, efficiency, and accuracy in reconciliation?

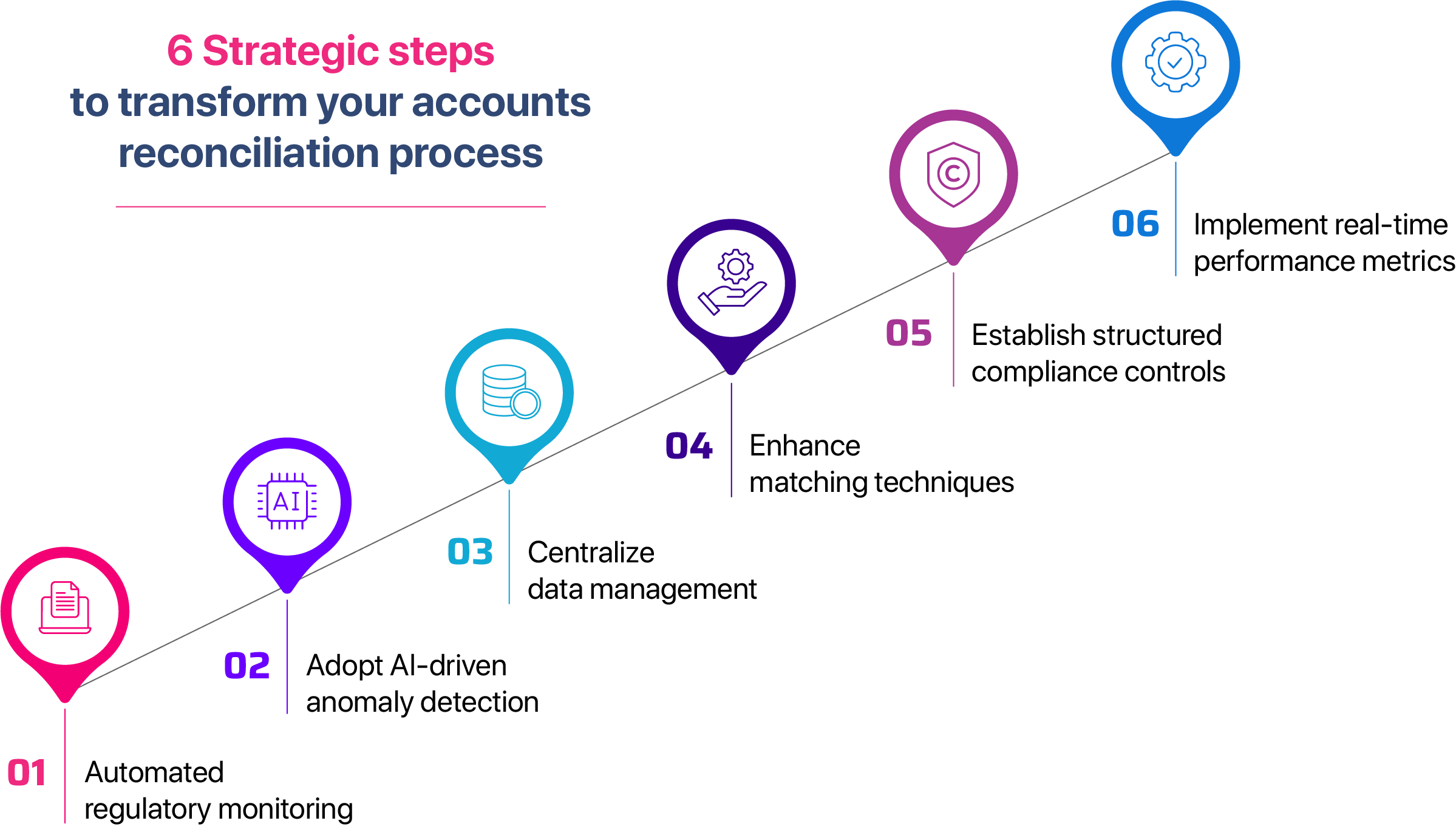

Aligning compliance, efficiency, and accuracy in accounts reconciliation requires a strategic blend of technology and robust operational frameworks. Automation plays a pivotal role in eliminating manual errors and accelerating processes. By leveraging AI and machine learning, organizations can detect anomalies, minimize discrepancies, and ensure data precision. This reduces the time spent on manual interventions, allowing teams to focus on higher-value activities. Centralized data management further streamlines reconciliation efforts. A unified system ensures consistent data accessibility, enhances transparency, and eliminates data silos that can lead to inefficiencies. By integrating advanced tools and maintaining comprehensive audit trails, organizations not only enhance operational efficiency but also strengthen their compliance posture.

Challenges in achieving seamless reconciliation processes

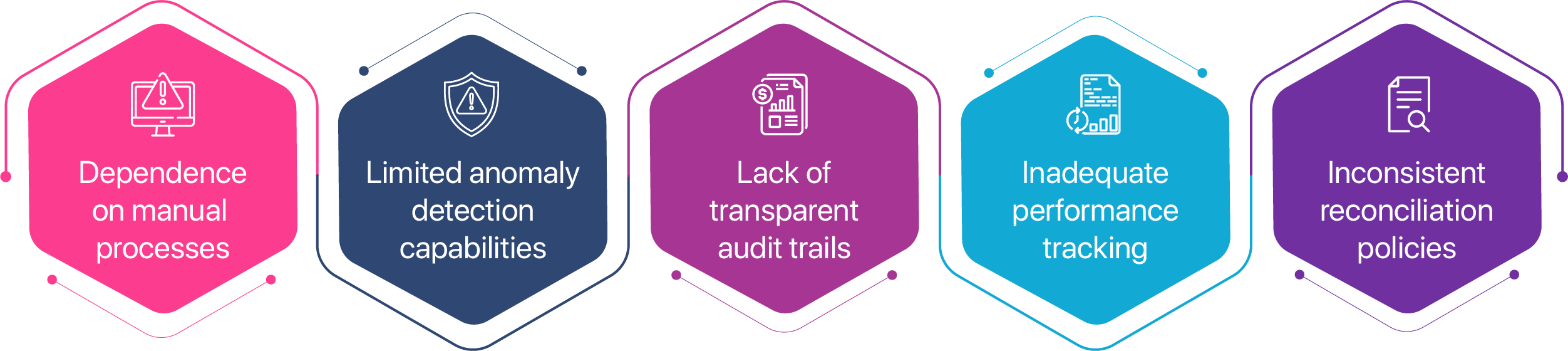

Relying on manual reconciliation methods increases the likelihood of errors, slows down workflows, and hinders real-time transaction validation, impacting overall accuracy and efficiency.

Traditional methods often fail to identify irregularities promptly, leaving organizations vulnerable to unnoticed discrepancies and compliance risks.

Without detailed records, tracking data changes and ensuring accountability becomes challenging, complicating audit readiness and financial reporting accuracy.

![]()

The absence of real-time monitoring tools makes it difficult to identify inefficiencies and optimize reconciliation workflows, potentially leading to misaligned organizational goals.

Variations in policies across teams or departments result in inconsistent execution, increased errors, and non-compliance with regulatory standards.

The transformative benefits of automation in reconciliation processes

Conclusion

Implementing automation in accounts reconciliation is a pivotal step for organizations seeking to modernize their financial operations. Beyond merely addressing inefficiencies, automation introduces a streamlined, proactive approach to managing complexities, ensuring processes are not only faster but also more reliable. By integrating real-time detection capabilities, businesses can confidently navigate discrepancies while staying aligned with regulatory standards.