Listen to this blog

If you’ve worked in mortgage operations long enough, you’ve seen how the work has changed. The files got heavier. The rules got tighter. The timelines got shorter. And that’s exactly why this new wave of AI feels different from anything we’ve seen before.

What used to be a collection of manual steps is slowly turning into a connected system, one that understands the file, predicts what’s missing, and helps teams stay ahead instead of catching up. AI isn’t just speeding up tasks; it’s reshaping how the mortgage lifecycle flows.

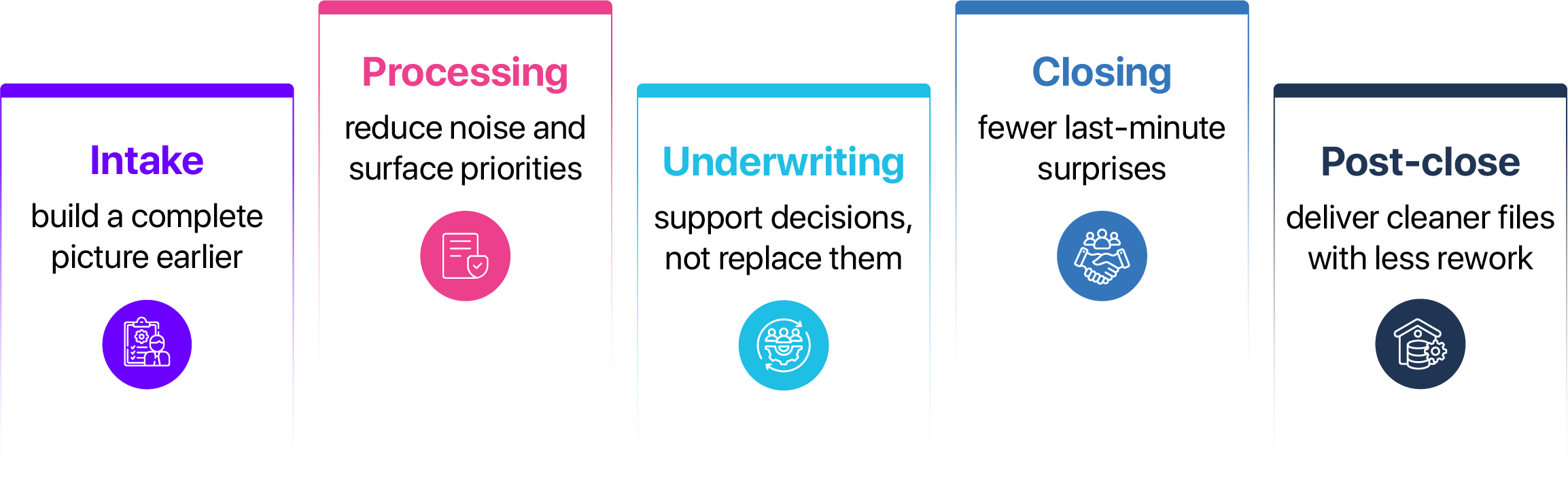

Intake: build a complete picture earlier

At intake, the biggest problem isn’t the documents, it’s the uncertainty. “Is this file ready?” “Is something missing?” “Will this come back later as a condition?”

AI helps eliminate that guesswork. Modern systems can look at a document set and understand what the lender expects, what’s missing, and which items may cause delays downstream. Recent market coverage shows lenders adopting AI to reduce early-stage backlogs and improve file completeness (HousingWire, Sept 2024). This gives processors and underwriters something they haven’t had consistently before: a clear, early read on file quality.

Processing: reduce noise and surface priorities

Processing has always been the “noise” stage, too much information, too little clarity. AI mortgage processing helps change that by narrowing the focus.

Instead of processors combing through every page, AI highlights mismatches, missing signatures, unclear income patterns, or rule-based exceptions. This isn’t theory, several industry reports show lenders using AI to prioritize conditions and cut repetitive checks (National Mortgage News, Aug 2024). The result is simple: teams stop searching for issues and start acting on them.

Underwriting: support decisions, not replace them

Underwriting has always required judgment. That won’t change. But the work around the decision, verifying numbers, confirming documents, matching income to deposits, is exactly where intelligent underwriting helps.

AI now supports underwriters with targeted checks, early risk signals, and clearer visibility into the file’s history. Recent data shows AI-supported underwriting helps reduce defect rates and improve consistency across teams (Fannie Mae Research, 2024).

Underwriters get cleaner files, fewer loops back to processing, and more time for the decisions that truly require human expertise.

Closing: fewer last-minute surprises

Closing delays usually come from small issues that surface too late, an outdated version, a missing page, a signature in the wrong place.

AI steps in by comparing document versions, checking for missing elements, and ensuring that the closing package matches investor and regulatory expectations before the borrower even touches a pen.

When closing teams know earlier what might derail the timeline, the borrower experience improves and the hand-off to post-close becomes smoother.

Post-close: deliver cleaner files with less rework

Anyone who has worked in post-close audits knows how much time goes into validating what’s already been completed. AI makes this stage more predictable.

It reviews the file holistically, flags inconsistencies, identifies potential defects, and helps auditors confirm whether the loan meets the required delivery standards. Industry coverage shows that lenders using AI at this stage see noticeable reductions in audit cycle times and defect rates (Mortgage Bankers Association, Oct 2024).

A cleaner post-close phase means faster delivery, fewer suspense items, and stronger investor confidence.

A future where the lifecycle works as one

The most interesting shift is what happens when AI connects all these phases. Intake insights inform underwriting. Underwriting patterns shape post-close reviews. Post-close findings improve intake rules. This creates a feedback loop the industry has never had before, a mortgage lifecycle that learns.

Why lenders should pay attention now

AI isn’t a “next decade” topic. It’s already reshaping daily work. Teams that adopt lifecycle intelligence will handle higher volume, reduce friction, and meet rising market expectations without adding more manual effort. The lenders who move now won’t just work faster, they’ll work smarter, with more clarity at every step.