Listen to this blog

The idea of “mortgage automation” used to mean predictable things, basic data capture, fixed rules, and routine validations. It helped, but it didn’t fundamentally change how lenders worked. What’s happening now is different. Next-generation AI is giving automation the ability to understand context, anticipate what comes next, and support decisions across the entire mortgage lifecycle.

This shift matters because lenders aren’t just trying to work faster, they’re trying to work with fewer surprises, fewer defects, and more predictable outcomes.

Automation that understands the file, not just the fields

Earlier automation could extract data. Today’s AI mortgage processing can interpret what a document represents, whether something is missing, and how that affects downstream steps.

For example:

- It can read a paystub and detect whether the income pattern aligns with the borrower profile.

- It can spot conditions before processors flag them manually.

- It can organize a file based on intent, not just labels.

This level of understanding is what makes automation “intelligent.” It’s no longer just moving documents, it’s helping teams know what’s ready and what needs attention.

Improving quality at the start of the lifecycle

Most problems downstream originate in intake and early processing. When automation can identify missing items and incomplete documentation earlier, lenders save hours of rework later.

Intelligent mortgage automation brings structure into intake by:

- Highlighting what’s missing from the borrower’s package

- Suggesting what documents need clarification

- Predicting which items might trigger conditions later

This creates cleaner files and reduces the back-and-forth that typically slows down processing.

Condition checks with more context

Condition clearing has always been one of the most repetitive parts of mortgage operations. AI now supports teams by comparing documents, cross-checking data, and identifying mismatches automatically.

Instead of processors reading every line to verify a condition manually, the system:

- Surfaces exceptions

- Confirms which documents satisfy the condition

- Flags inconsistencies across the file

This makes automated mortgage processing more reliable and reduces the time spent on repetitive review cycles.

Underwriting that stays focused on judgment

Underwriting will always require human judgment, but AI can reduce the workload leading up to that decision. With intelligent underwriting, the system prepares the file, validates math, matches income patterns, and checks documentation completeness, before the underwriter even opens it.

The benefit is simple:

Underwriters get cleaner, more predictable files and can focus on decisions, not data gathering.

More predictable downstream steps

Closing and post-close depend heavily on everything that came before. When upstream automation is stronger, downstream work becomes more predictable.

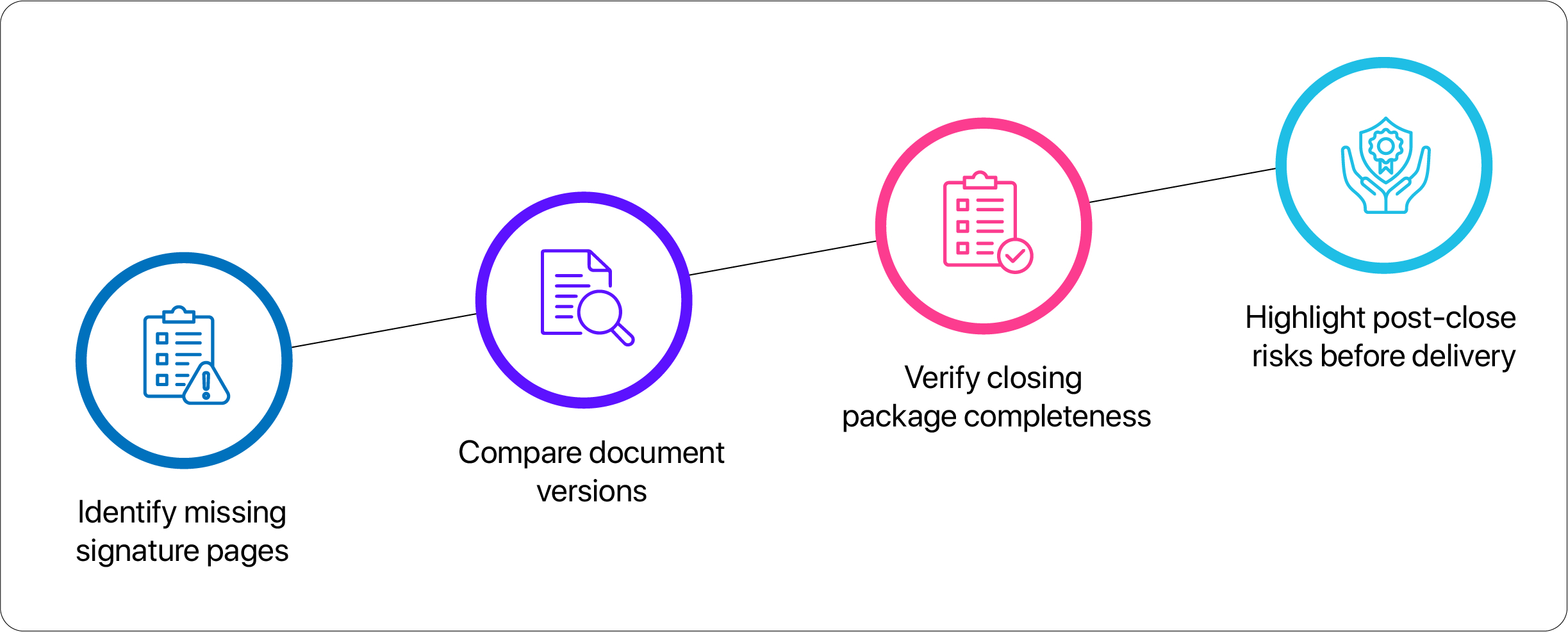

AI can:

- Identify missing signature pages

- Compare document versions

- Verify closing package completeness

- Highlight post-close risks before delivery

This reduces last-minute issues at closing and supports cleaner post-close audits with fewer suspense items.

A preview of what’s next: reasoning-driven and agent-based AI

The next wave of automation goes beyond task execution. AI systems are becoming reasoning-driven and agent-based, meaning they can coordinate multiple steps, learn from past files, and make recommendations across the entire mortgage lifecycle.

Instead of just completing tasks, these systems will help lenders:

- Predict defects before they occur

- Organize file flow based on complexity

- Route files to the right teams automatically

- Guide users through next best actions

This isn’t distant. Early versions of these capabilities are already emerging across financial processes.

Why lenders should pay attention

Automation isn’t about replacing teams. It’s about giving them leverage so they can handle volume without sacrificing quality. Next-gen AI gives lenders exactly that:

- Cleaner inputs

- Faster review cycles

- Fewer defects

- More predictable outcomes

- A lifecycle that learns and adapts

The lenders who adopt intelligent automation now will be the ones prepared for the way mortgage operations actually work going forward not just faster, but smarter at every stage.