Listen to this blog

Introduction

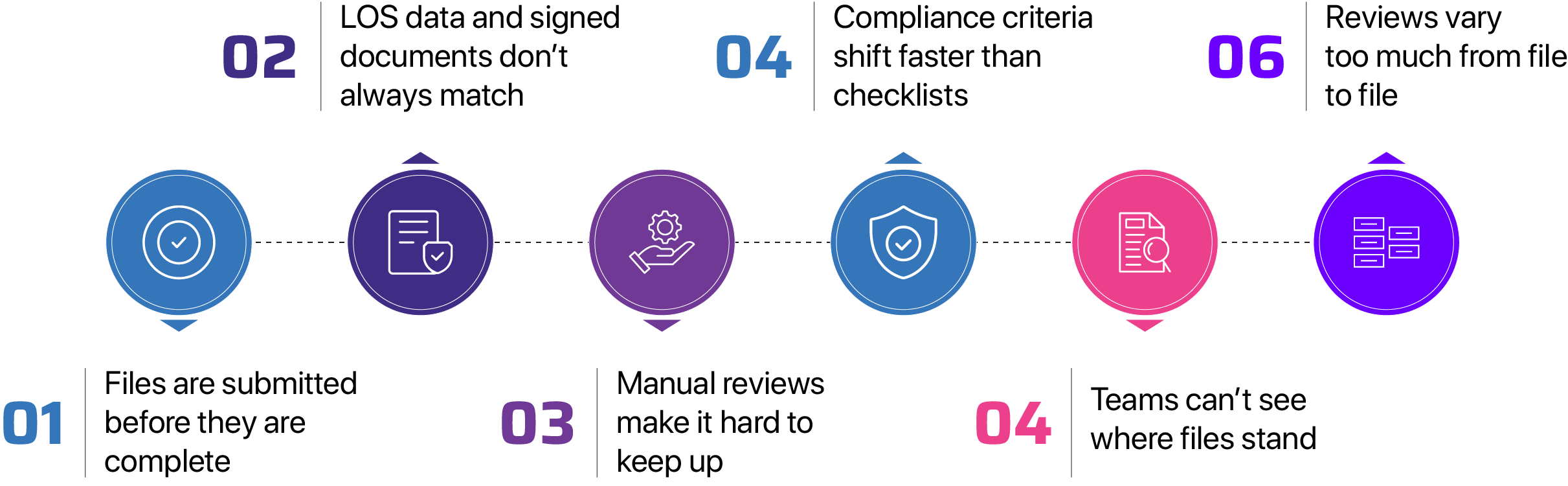

Post-close audits often reveal what went unnoticed during the rush to close: missing documents, mismatched data, and outdated compliance checks. These issues don’t just slow down delivery, they create friction with investors, increase operational costs, and weaken lender confidence in their pipeline.

Visionet has worked with mortgage leaders to understand where these gaps begin and how they can be avoided. The answer is not more oversight, it’s building audit intelligence directly into the process. Here are six challenges we help resolve early, so loans move forward without last-minute surprises.

It’s common for final title policies or insurance records to lag. But when loans move into audit without all the required documents, it creates follow-ups, suspense entries, and unnecessary handoffs.

The right approach is not only chasing paperwork but also building real-time tracking directly into the workflow, so that audit teams work with fully assembled files from the start.

Minor discrepancies between the loan origination system and the closing documents, like a misspelled name or an outdated rate, can derail a file late in the process. These errors often slip by until they are flagged in an investor review.

A validation layer that compares critical data across both systems is essential. It catches mismatches early and reduces file defects before submission.

When audit teams rely on spreadsheets and static checklists, quality becomes inconsistent, especially when loan volumes rise. The work is repetitive, and the risk of oversight increases.

Automating routine checks allows teams to focus where their expertise matters most on resolving edge cases and exceptions, not ticking boxes.

Investor delivery guidelines are constantly evolving. But internal checklists don’t always keep pace, and teams may interpret them differently, resulting in inconsistent audits and repurchase exposure.

An audit platform that updates requirements automatically and applies them uniformly ensures reviewers are always working from current standards

Without a shared view into audit status, delays become inevitable. QC, closing, and post-close teams duplicate efforts or miss deadlines because no one knows exactly where a file stands.

A single dashboard showing file readiness, unresolved issues, and exception history improves visibility and moves files forward without guesswork.

No lender wants investors second-guessing file quality. But inconsistent audits caused by different teams interpreting requirements their own way can lead to unpredictable delivery results.

Standardizing logic, rules, and audit depth across all files builds confidence at every level of the origination process.

Conclusion

Post-close audits should not feel like a scramble to catch mistakes. They should confirm the process worked exactly as it should. That’s the mindset leading lenders are adopting: design workflows that surface issues early, resolve them quickly, and keep the delivery pipeline clean.

That’s also where technology and the right operational partnership make a measurable difference.

Visionet makes mortgage origination feel effortless

Lenders today are operating in a highly competitive market, where fast, accurate file processing is critical to stay ahead. Every day of delay affects funding timelines, investor delivery, and overall efficiency, especially when teams are managing tight compliance requirements and large volumes of documentation.

Visionet’s solutions are designed to ease that pressure. It doesn’t just automate steps, it helps teams work with greater clarity. Borrowers can upload documents from their phones. Files are flagged automatically when something is missing or doesn’t match. Audit teams get a clear view of what needs attention, well before the files are submitted.