Listen to this blog

Introduction

We’ve all done it, left the house, and realized we forgot something important. Maybe it was your wallet, your keys, or that one form you needed. In everyday life, it’s usually a small inconvenience. But in the mortgage world, especially when preparing loans for the secondary market, small misses can have big consequences.

Missing a single document or leaving one detail unchecked can slow down funding, hold up investor reviews, or even lead to costly repurchase requests.

In this blog, we’ll walk through the core checks that help make a loan file truly ready for the secondary market and why it’s better to catch issues early than scramble later.

When loan documents are scattered or labeled incorrectly, they slow down the review process. For example, if income documents get placed with credit records, it becomes harder for auditors to follow the story of the loan.

Setting up a clear and consistent way to name, sort, and place documents right from the start saves time and builds trust in the file.

It’s easy to overlook small differences, like a borrower’s name being spelled two ways or loan terms listed slightly differently across systems. But these differences can raise red flags for investors.

Getting everything aligned between documents and system records early in the process avoids last-minute corrections and helps the file move forward smoothly.

Not all investors follow the same checklist. What works for one buyer might fall short for another. Using a single checklist for all loans can lead to missing items and delays during reviews.

It’s smarter to follow investor-specific requirements right from the beginning so the loan file meets the right expectations before it ever leaves your hands.

Some paperwork doesn’t arrive at closing like recorded deeds or final title documents. But just because they come later doesn’t mean they can be forgotten.

Having a system to track these trailing documents ensures they’re followed up on and filed correctly before they become a problem.

When investors review loans, they’re not just checking the documents they’re also checking the process. They want to know what was reviewed, who made updates, and how exceptions were handled.

A clear trail of activity helps prove the loan’s integrity and reduces back-and-forth during reviews.

Visionet’s role in making it all come together

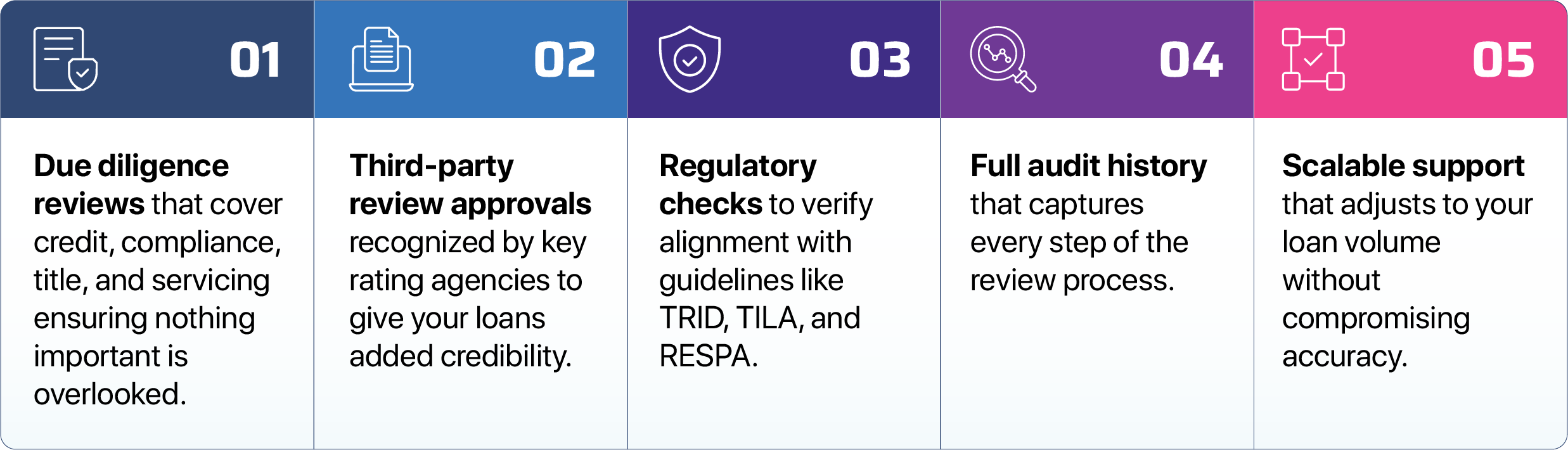

Visionet helps lenders stay ahead in secondary market preparation by offering services and tools that fit directly into their operations:

Conclusion: Audit readiness isn’t an afterthought

Getting a loan ready for the secondary market isn’t something that happens at the last minute. It’s a habit that starts early and touches every part of the file. When each step is done right from the beginning, everything moves faster, smoother, and with fewer surprises. Visionet helps make that possible by giving lenders the tools, insight, and support they need to stay prepared, stay accurate, and deliver with confidence and hence Automation isn't just about efficiency it's about delivering complete, compliant loan packages on time, every time, before they enter the securitization pipeline.