Listen to this blog

Introduction

We’ve all experienced that last-minute scramble, digging through drawers for a misplaced file, scanning inboxes for a missing attachment. Now imagine that tension playing out every day in your mortgage post-closing department.

It’s not a case of one-off chaos. It’s the result of complex processes, disconnected systems, and limited visibility into key documents that are essential to closing out a loan file properly.

If your post-close operation still relies on manual follow-ups, offline trackers, or reactive cleanup, Visionet offers a better way forward.

How post-closing gaps impact compliance and investor delivery

When post-closing workflows lack consistency or completeness, the impact extends far beyond routine delays, it creates vulnerabilities across the entire lending and delivery lifecycle. Delayed submission of final documents can disrupt investor timelines and jeopardize loan salability. Inadequate quality control increases the potential for repurchase demands and exposes lenders to regulatory scrutiny. Missing or untracked items, such as lien releases and title policies, introduce legal and servicing complications that can erode trust and increase operational risk. Meanwhile, internal teams often spend disproportionate time chasing down documents instead of focusing on strategic, revenue-driving activities. These challenges underscore the need for a smarter, more automated post-closing framework.

Visionet delivers structure, automation, and control

With over two decades of experience in mortgage operations, Visionet helps lenders modernize the post-closing lifecycle by blending technology, automation, and expert services to ensure each loan is audit-ready, compliant, and complete. As part of this offering, DocVu.AI supports key automation tasks within Visionet’s broader, end-to-end solutions that goes far beyond basic document management.

Key post-closing services we offer

At Visionet, our post-closing support is built to help lenders cure, perfect, and complete collateral files. Here’s how we do it:

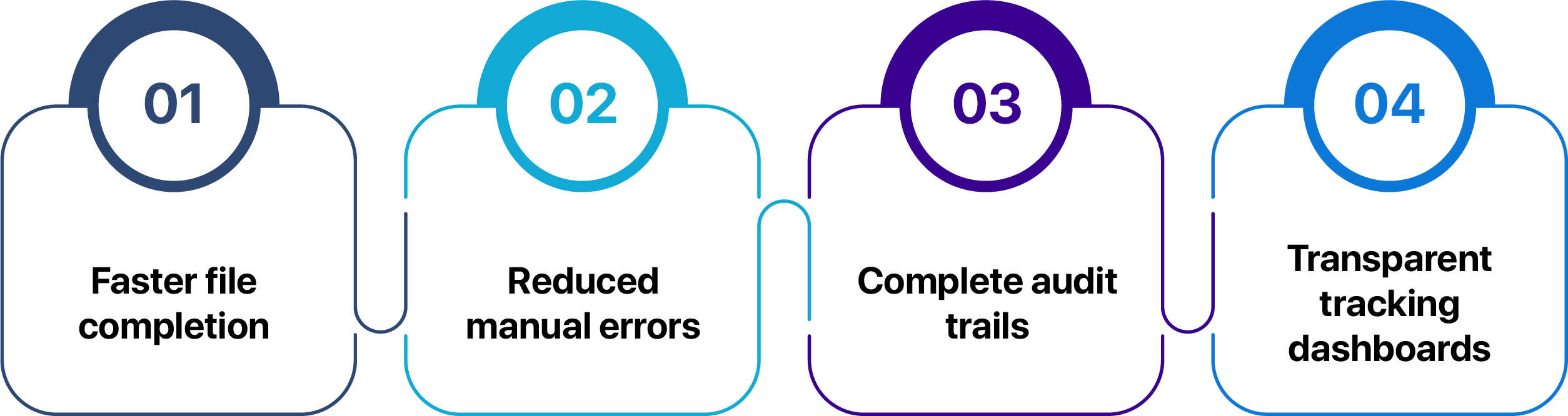

Visionet’s post-close QC service is designed to help lenders deliver high-quality, audit-ready loan files with speed and confidence. Our process combines intelligent automation with experienced audit teams to review each file for accuracy, completeness, and data consistency. By automating document validation and layering in expert judgment, we reduce manual effort, minimize downstream corrections, and accelerate loan delivery. This results in fewer exceptions, faster resolution cycles, and improved investor readiness, ultimately helping lenders reduce operational risk, enhance compliance confidence, and protect profitability at the most critical stage of the mortgage lifecycle.

We provide comprehensive support for the generation and packaging of final title policies. Our services ensure that all necessary documentation, including recorded deeds, mortgage documents, and settlement statements, are accurately compiled and reviewed. By adhering to investor templates and requirements, we facilitate the creation of complete and audit-ready policy packages, ready for seamless loan boarding and compliance verification. This meticulous approach helps lenders maintain regulatory compliance and enhances the efficiency of the post-closing process.

For clients who require physical document delivery, we offer secure, high-volume print and distribution capabilities, including post-closing packages and disclosures.

A smarter approach to post-close audits and delivery

With DocVu.AI, Visionet automates time-consuming post-close tasks, auto-stacking documents, extracting data, flagging gaps, and aligning with compliance rules.

The result?

Instead of managing follow-ups manually, your team works on exceptions. Instead of chasing documents, you're monitoring performance.

Why lenders choose Visionet

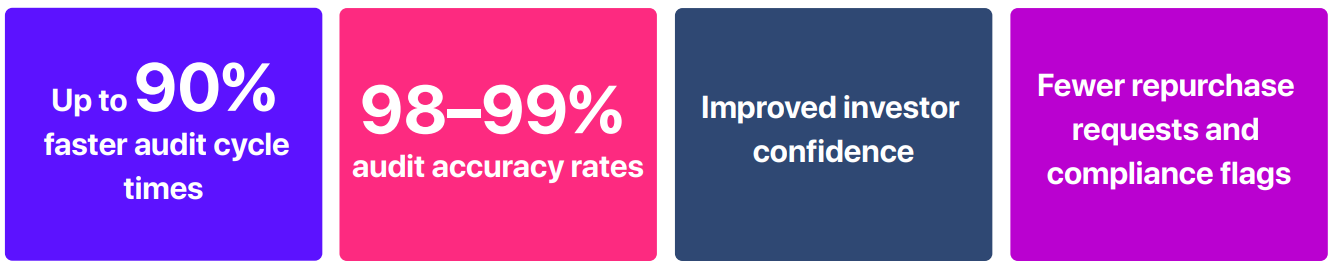

Our solution isn’t just software, it’s a fully supported mortgage audit ecosystem. Lenders who partner with us report:

Visionet’s post-closing solutions are designed to scale with your operations, whether you're managing 500 loans a month or 50,000.

Transform post-closing into a strategic advantage

In today’s lending environment, where compliance timelines are tight and investor expectations are high, post-closing cannot remain a reactive function. Visionet empowers lenders with automation-driven processes, audit visibility, and scalable service models that reduce exceptions and accelerate delivery. If your current workflows rely on manual tracking and fragmented systems, it's time to transition to an infrastructure built for accuracy, transparency, and growth.

Reach out to us today to discover how our automated solutions can take your mortgage operations to the next level!