Listen to this blog

Underwriting used to be defined by document checks, calculations, and data matching. Important work, but time consuming. What is changing now is the intelligence around the underwriting process. The new generation of mortgage automation solutions goes beyond extraction and early red flags. It helps lenders build decision systems that understand patterns, predict risk movement, and guide underwriters toward clearer, more confident outcomes.

If you spend time in underwriting, you know the challenge is not just the volume of information. It is how quickly you can turn scattered data points into a complete risk picture. This is exactly where advanced automation is reshaping the process.

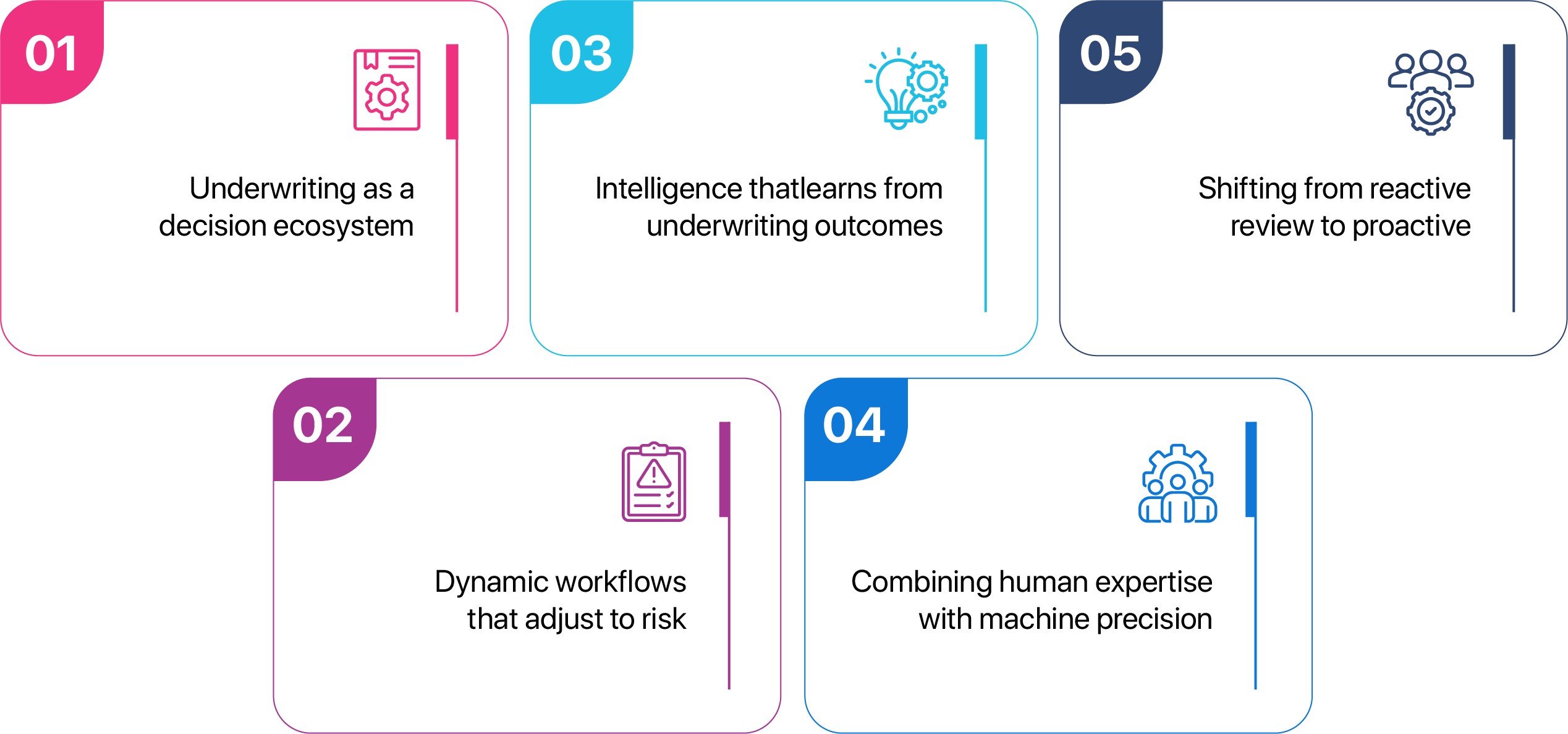

1. Underwriting as a decision ecosystem

Modern lenders are moving away from treating underwriting as a linear checklist. Instead, they are building decision ecosystems where information, signals, and workflows talk to each other.

Underwriters gain a better understanding of:

- how borrower behavior is shifting

- how income stability aligns with current market trends

- how document patterns predict conditions or exceptions

- how risk factors evolve as the file moves forward

With AI mortgage processing, the system does not wait for the underwriter to catch something manually. It interprets documents, compares data across the file, and predicts what might need deeper attention. This helps underwriters work with a complete picture from the beginning, not halfway through.

2. Dynamic workflows that adjust to risk

Files are not equal. Some move smoothly. Some demand extensive analysis. Many fall somewhere in the middle. Yet most underwriting workflows treat them the same.

Next-generation underwriting automation adjusts automatically. Workflows shift based on complexity, early indicators, and the underwriter’s preferred decision style. A file showing income variability, rental activity, or mixed credit behavior is routed for deeper review while strong files move faster.

This type of automated risk assessment prevents backlog, reduces over-reviewing, and ensures the right talent focuses on the right files.

3. Intelligence that learns from underwriting outcomes

One of the most important changes is that underwriters are no longer working blind to historical outcomes. Automation can learn from past decisions and surface patterns that humans might miss.

These patterns include:

- gig income volatility by segment

- borrower lifecycle shifts, such as mid-year employment transitions

- property micro-trends tied to specific ZIP codes

- recurring documentation mismatches that signal potential defects

Underwriters gain insight into risk drivers that were previously buried in old files, spreadsheets, or audits. This turns decision support into a forward-looking resource rather than a retroactive check.

4. Combining human expertise with machine precision

Underwriters do not need more automation. They need the right kind of automation. The goal is not to replace decisions but to reduce friction around them.

With intelligent underwriting, AI handles the structured work:

- validating values

- matching documents

- checking stability patterns

- highlighting inconsistent data

- comparing the file to portfolio outcomes

Underwriters then spend more time on judgment, borrower context, and the nuances that machines cannot interpret. This partnership improves accuracy and reduces defects without reducing control.

5. Shifting from reactive review to proactive

Traditionally, underwriting reacts to what appears in the file. Modern automation enables proactive decision architecture. That means underwriters can shape how future files move based on what they learn today.

For example:

- if a pattern repeatedly causes conditions, rules can be updated

- if a recurring document type creates confusion, the pipeline can reorganize it

- if certain risks consistently emerge late, early signals can be added

This creates a smarter, more adaptive underwriting framework built from real outcomes, not assumptions.

The path forward for lenders

The future of underwriting is not about speed alone. It is about clarity. It is about helping underwriters work with context instead of noise. It is about learning from every decision and improving the next.

Lenders who integrate mortgage automation solutions, predictive signals, and continuous learning will evaluate risk not only faster but with more confidence and less friction. This is how underwriting becomes both efficient and deeply informed.