Listen to this blog

Origination costs rarely come from the obvious places. Most lenders already automate or outsource parts of the lifecycle, yet cost-to-originate keeps rising. That means the real drivers sit deeper. They live in handoff delays, inconsistent data, unclear workload signals, and workflows that are not aligned from intake to post-close.

In 2026, meaningful mortgage cost reduction will come from fixing these hidden inefficiencies, not just speeding up tasks. This guide focuses on the practical levers that matter most.

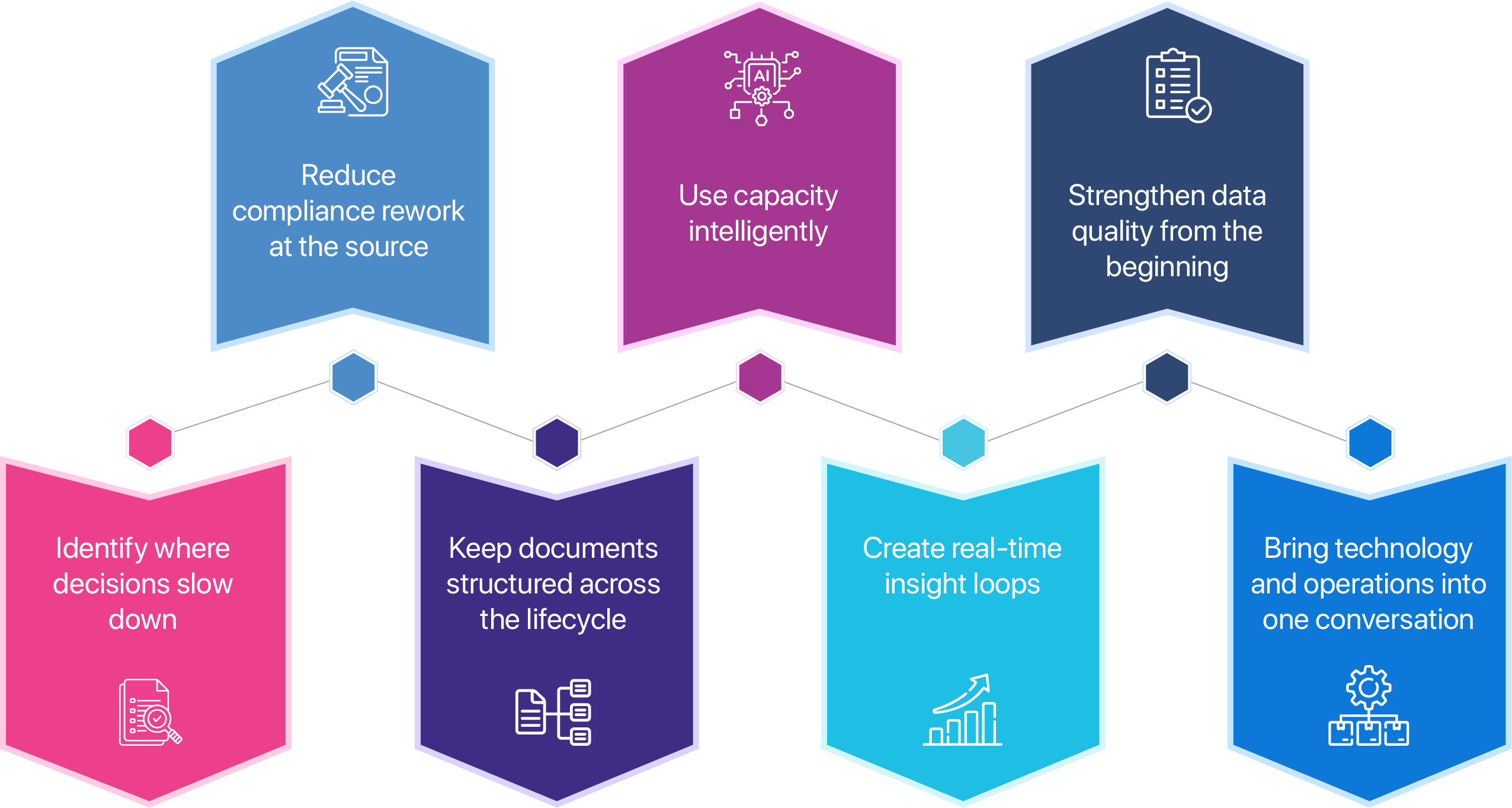

1. Identify where decisions slow down

Files often move slowly because decisions move slowly. A file can sit untouched simply because the next team does not know it is ready. A missing item can go unnoticed until underwriting. A cleared condition may not reach the reviewer at the right time.

Small delays add up across the pipeline and increase cost per loan.

Lenders can cut this dramatically with modern workflow signals that show readiness, highlight exceptions early, and keep teams aligned. Faster decisions naturally support mortgage cost reduction without adding more effort.

2. Reduce compliance rework at the source

Compliance rework is expensive because it multiplies across teams. Inconsistent documentation, unclear values, or mismatched data often turn into conditions, delays, and repeat cycles.

This is where AI mortgage processing helps. Instead of checking documents in isolation, AI compares information across the file and flags inconsistencies when they first appear. Clean data early means fewer corrections during underwriting and fewer defects during post-close.

3. Keep documents structured across the lifecycle

Documents tend to lose structure as they move through intake, processing, and underwriting. Updated versions get misplaced, pages get mislabeled, and people spend more time searching than reviewing.

An intelligent document pipeline solves this by keeping documents organized from start to finish. It maintains the correct order, tracks versions, and highlights what needs human review. When documents flow smoothly, teams avoid unnecessary work and automated mortgage processing becomes more effective.

4. Use capacity intelligently

Fixed staffing models do not match the real pace of origination. Some weeks overwhelm teams, while others leave capacity underused. Both situations add cost.

Dynamic capacity planning, guided by actual file readiness and complexity, helps lenders match resources to workload. When capacity flexes with demand, teams prevent bottlenecks, reduce overtime, and gain more predictable operations.

5. Create real-time insight loops

A major hidden cost comes from limited visibility between teams. When processors, underwriters, closers, and post-close teams see only their part of the file, issues surface too late.

Real-time insight loops give everyone a shared view of:

- what is complete

- what is missing

- what will likely cause defects

- where patterns are repeating

These insight loops strengthen intelligent mortgage automation by reducing second touches and preventing downstream rework.

6. Strengthen data quality from the beginning

Data errors grow quickly. A small mismatch at intake becomes a condition. A condition becomes a delay. A delay becomes a post-close defect.

Stronger data governance prevents this chain reaction. Clear standards, reliable validation, and consistent mapping ensure files move cleanly through the lifecycle without constant fixes. When data stays stable, cost naturally drops.

7. Bring technology and operations into one conversation

Many cost issues come from misalignment between systems and real workflows. Intelligent mortgage automation works best when operations teams help design how documents move, how validations work, and how exceptions are handled.

When lenders combine structured document pipelines, early validation, and real-time workflow insight, the process becomes lighter and requires fewer touches.

This is where the strongest mortgage cost reduction happens.

The real advantage in 2026

Lower origination cost is not about pushing teams harder. It is about removing the hidden friction that slows files down and creates avoidable work.

When decisions move quickly, documents stay organized, capacity is balanced, and data stays consistent, lenders reduce cost in ways traditional process tweaks cannot achieve.

2026 rewards lenders who focus on clarity, structure, and smarter movement, not just automation for the sake of automation.