In real estate, speed is often the difference between a seamless closing and a deal that falls through. Title search, a fundamental step to confirm ownership and uncover encumbrances, is one of the most common causes of transaction delays. In 2025, when borrowers expect faster closings and investors demand accuracy, inefficiencies in title search are no longer just inconvenient, they are business risks.

The complexity is growing as transaction volumes increase, digital records remain inconsistent across counties, and compliance standards tighten. At the same time, real estate professionals are under pressure to manage costs while improving the borrower experience. These forces make title search not just a technical necessity but a defining factor for lender reputation and operational maturity. Seven pressing challenges continue to slow down title search - understanding them is critical to achieving smoother, faster transactions.

The Stakes of a Slow Title Search

Delays in title search ripple across the entire transaction lifecycle. Recent ALTA research shows that about 36% of files are difficult, demanding extensive curative work. Title teams spend 22 hours on standard files and 45 hours on difficult ones, adding real time and complexity before closing. These setbacks extend cycle times, increase operational costs, frustrate borrowers, and erode trust among investors.

For borrowers, waiting weeks for a title report can mean losing a property to a faster-moving competitor or paying more because of rate-lock expirations. For lenders, extended timelines add servicing costs and increase the likelihood of last-minute fall-throughs, which directly affects profitability. Investors and secondary market players also view these delays as indicators of weak operational discipline, which can reduce confidence in the institution’s overall portfolio management.

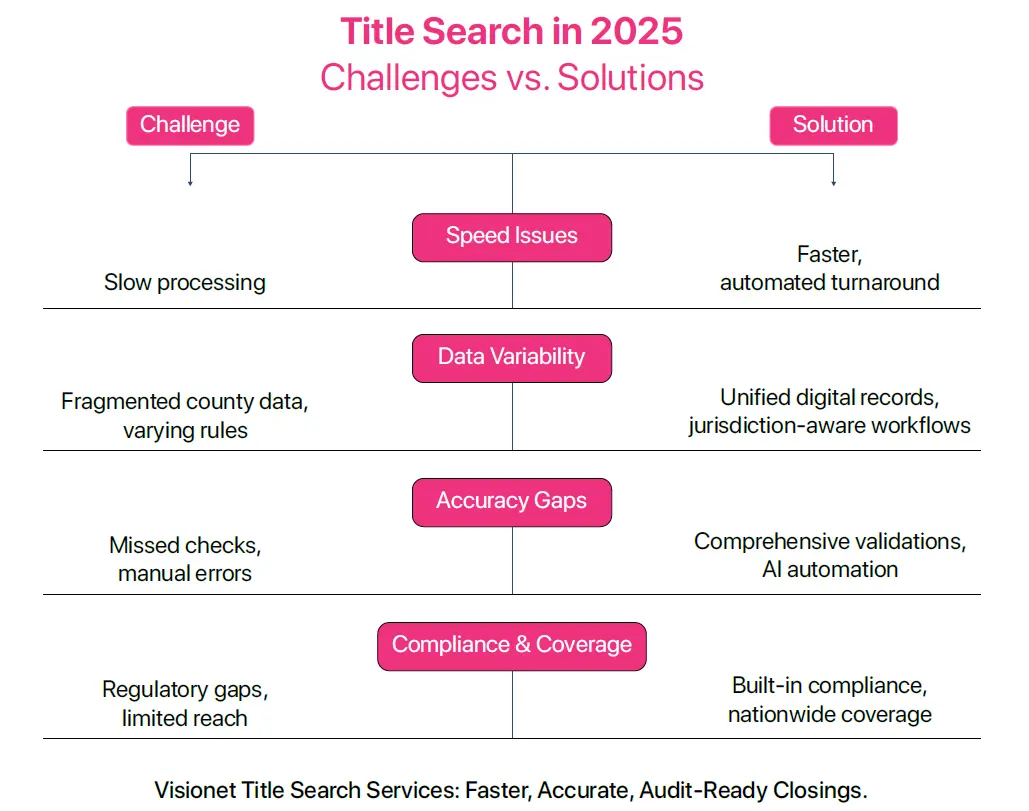

Seven Title Search Challenges in 2025

Here are seven reasons title search continues to delay real estate closings in 2025:

- Inconsistent County-Level Data

With over 3,000 counties in the U.S., data quality varies from fully digitized systems to handwritten archives. This inconsistency forces manual retrieval, increases turnaround time, and makes it difficult to establish uniform workflows. - Jurisdictional Variations

Every state and often each county imposes unique forms, timelines, and recording standards. For nationwide lenders, managing this patchwork without automation is resource-heavy and a frequent cause of rejections. - Incomplete Encumbrance Checks

Overlooking liens, judgments, or easements not only delays transactions but can also trigger costly legal disputes later. A single missed encumbrance can undermine investor trust and erode borrower confidence. - Manual Errors

Human mistakes such as typos, misfiled records, or incorrect interpretations of ownership history remain common. These errors often require multiple back-and-forths with county offices, dragging out the process. - Compliance Gaps

Regulators and investors demand rigorous adherence to standards. Missing supporting documents or failing to meet guidelines can result in penalties, resubmissions, and reputational risk for lenders. - Limited Nationwide Coverage

Regional service providers may be effective locally but often struggle to deliver consistent quality at scale. For large lenders, gaps in coverage translate directly into fragmented operations and longer timelines. - Slow Turnaround Times

Traditional methods, dependent on manual searches and county-level delays, can stretch into weeks. In a competitive market, slow title reporting often causes borrowers to look elsewhere, jeopardizing deal closure.

How Visionet Accelerates Title Search

Real estate professionals and lenders need more than manual fixes; they need scalable solutions. That’s where modernized title search services come in. Visionet’s approach combines technology-enabled automation, nationwide coverage, and domain expertise to address the exact challenges outlined above:

- Digitized County Record Integration ensures data is unified and structured.

- Jurisdiction-Aware Workflows accommodate diverse state and county rules.

- Comprehensive Encumbrance Checks validate liens, easements, and judgments.

- Automation & AI Validation minimize human error and accelerate reviews.

- Built-in Compliance Frameworks align with investor and regulatory standards.

- Nationwide Coverage Network delivers consistent quality across geographies.

- Accelerated Turnaround reduces cycle times and supports faster closings.

Moving from Delays to Confidence

In 2025, title search is no longer a routine task in the background of real estate transactions. As compliance demands grow and borrower expectations tighten, a streamlined title search process has become a cornerstone of confident, on-time closings.

By modernizing title search, real estate professionals can minimize risk, shorten timelines, and create a smoother closing experience. With technology, coverage, and expertise working together, the shift from outdated methods to intelligent processes is no longer optional - it’s the new standard for confident, on-time closings.