In 2025, the mortgage landscape demands more with less. Compliance windows are tightening, investors scrutinize operations, and borrowers won’t bear delays. What used to be a “back-office formality” - the lien release, has become a visible test of operational maturity. A misstep here can trigger penalties, reputational risk, and borrower dissatisfaction.

At Visionet, we see lien release modernization as a transformative elevation, not just a digitization project. With deep domain experience and our VisiRelease solution, we help lenders shift from error-prone manual workflows into a consistent, audit-ready process that scales across jurisdictions.

The Risks of Staying Manual in Lien Release

Handling lien release manually might seem low risk until a mistake or delay triggers cascading issues:

- Compliance penalties & legal exposure: Many states impose strict deadlines for releasing a lien once a mortgage is paid; missing them can result in fines or potential litigation.

- High rejection rates & rework: Erroneous or incomplete submissions to county recorders often get rejected, leading to rework and backlogs.

- Operating cost burden: Manual checks, data entry, and county follow-ups demand staff time and introduce human error.

- Variability across jurisdictions: Each county has unique forms, fees, and rules; manual handling increases inconsistency and risk.

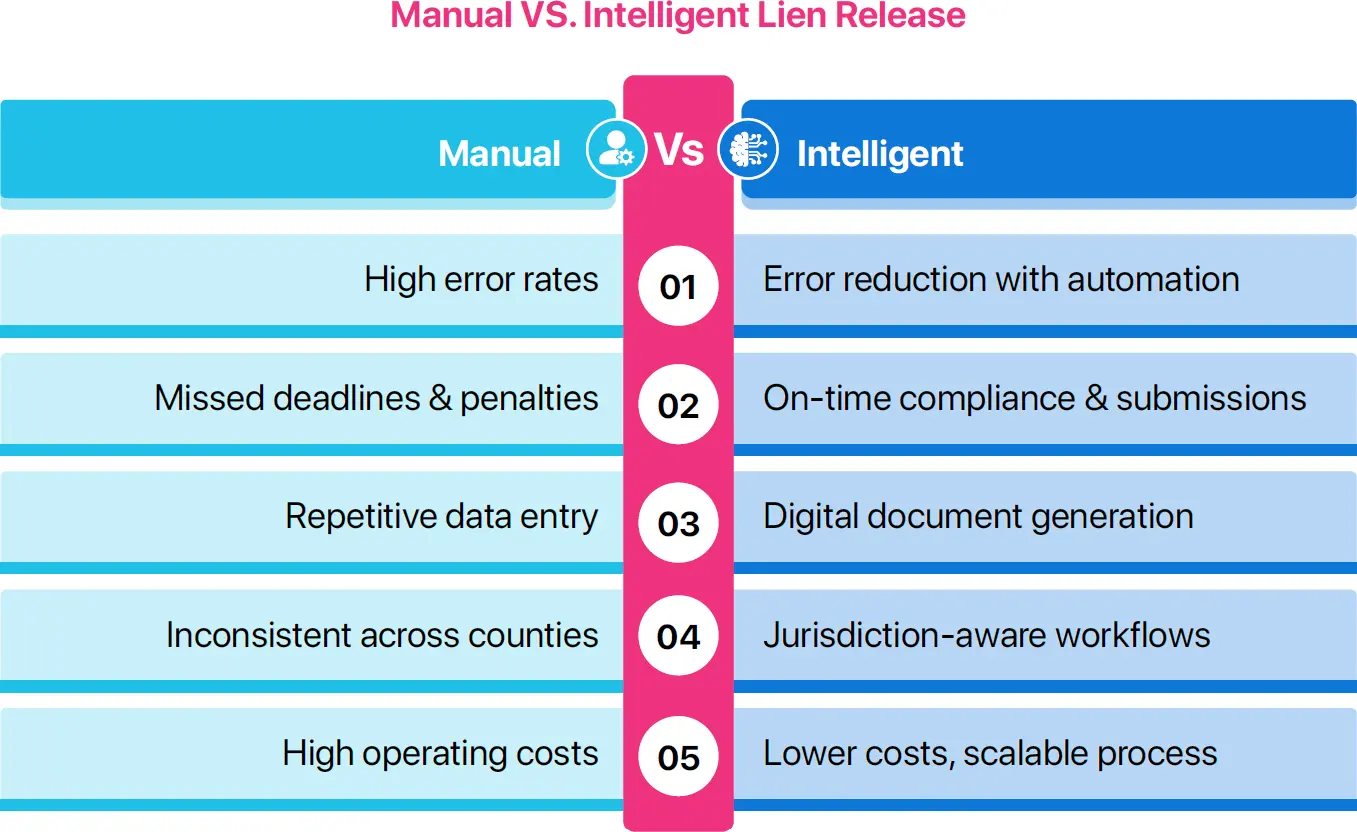

Manual vs. Intelligent Lien Release at a Glance

Manual lien release creates risks and delays, while intelligent methods deliver accuracy and efficiency. Before diving into the process of modernizing lien release, let’s see the difference between manual processes and intelligent workflows:

Six Steps to Modernize Lien Release

Here are six practical steps lenders and servicers can adopt to transform lien release into a robust, intelligent process:

- Standardize Data Intake & Centralize Capture

Using digital intake and centralized repositories reduces repetitive data input while improving accuracy across the process. A uniform intake process ensures that every lien release starts with complete, accurate borrower and loan data, forming a reliable foundation for automation. - Automate Validation & Compliance Logic

Every lien release must align with investor requirements, state regulations, and county-specific rules. Manual checks are prone to errors and inconsistencies, but automation can apply predefined business rules instantly. AI and machine learning tools can cross-check payoff amounts, borrower identifiers, and county mandates, flagging issues before submission. This proactive approach not only improves accuracy but also reduces costly rejections. - Support Jurisdiction-Aware Workflows

With more than 3,000 counties across the U.S., no two workflows look exactly the same. Jurisdiction-aware automation allows lenders to dynamically adapt forms, timelines, and approval processes for each county. Instead of forcing one-size-fits-all templates, intelligent workflows account for local variations - a critical step toward achieving true scalability. - Generate & Track Documents Automatically

Document preparation is often a bottleneck when handled manually. Automated generation of lien release and assignment documents speeds up the process and minimizes human error. Real-time tracking enhances transparency by enabling teams to monitor submission progress, route documents for approvals or signatures, and receive timely alerts on pending tasks. - Integrate with Core Mortgage & Title Systems

Siloed systems create unnecessary rework and slow down processing. By integrating lien release workflows with servicing platforms, title systems, and custodial solutions, data flows seamlessly without manual re-entry. This integration not only saves time but also provides end-to-end visibility, ensuring every stakeholder has access to consistent, up-to-date information. - Embed Transparency & Audit Controls

Regulatory scrutiny around lien release is growing. Embedding audit trails, approval logs, and compliance dashboards into the process ensures that every step is tracked and verifiable. These audit-ready controls simplify reporting, reduce the burden of external reviews, and build confidence with investors and regulators alike. Ultimately, transparency transforms lien release from a compliance headache into a point of trust.

Visionet’s Advantage: VisiRelease in Action

VisiRelease is Visionet’s dedicated product for mortgage recording and lien release. It is a workflow-based solution designed to simplify document preparation, streamline county communication, ensure compliance, and manage release operations with accuracy and scale.

Here are a few of its standout capabilities:

- Assignment & Satisfaction Modules – Automates creation of assignment and lien satisfaction (reconveyance) documents, with support for eSign and eNotary to speed up approvals.

- e-Recording & County Submission – Ensures accurate electronic submissions, manages county-level follow-ups, and retrieves recorded documents with fewer rejections.

- Collateral File Vault & Lifecycle Management – Digitizes physical files, maintains them securely in a vault, and automates purging after retention periods.

- Audit-Ready Transparency – Embeds comprehensive tracking, logs, and reports, making it easier to demonstrate compliance to regulators and investors.

- Jurisdiction-Aware Intelligence – Adapts to county- and state-specific requirements, reducing variability and ensuring consistency nationwide.

- Accelerated Turnaround – By combining automation with domain expertise, it reduces cycle times and operational costs while improving borrower and investor confidence.

When combined with our process expertise, VisiRelease enables lenders to reduce cycle times, lower rejection rates, and strengthen operational confidence. Built with advanced automation and ML/AI capabilities, it consistently delivers among the lowest county rejection rates in the industry. Serving as a natural execution engine for a modern lien release playbook, VisiRelease aligns perfectly with the six steps outlined above.

Building Trust Through Intelligent Lien Release

Lien release is no longer a mundane administrative task. It’s a milestone where lenders prove operational discipline, regulatory fidelity, and customer respect. Staying manual here is a gamble - mistakes, delays, and reputational impact loom large.

With the six steps above, lenders can evolve toward truly intelligent lien release. Visionet’s domain strength and VisiRelease solution then help embed consistency, efficiency, and compliance across the mortgage stack.