Listen to this blog

Introduction

In 2025, finance leaders are not only closing books; they are also building systems from the ground up that put accuracy, flexibility, and oversight first. As the standards for compliance in financial reporting get higher, it is becoming harder and harder to keep using manual invoice processing, siloed ledgers, and fragmented audits. The change is clear: finance offices are moving toward automated finance operations that are faster, more open, and give them more control. This blog talks about how Visionet helps companies update their accounts payable automation and reporting cycles by using structured, audit-ready frameworks. For CFOs, the goal goes beyond just being efficient. They also want to make sure that every financial function is clear, controlled, and compliant all the time.

This blog examines the shift toward automated finance operations, integrated compliance in financial reporting, and systems designed to support audit-readiness. Based on Visionet’s work with global enterprises, we explore how automation and intelligent data processing are reshaping critical areas such as accounts payable automation and order-to-cash cycles.

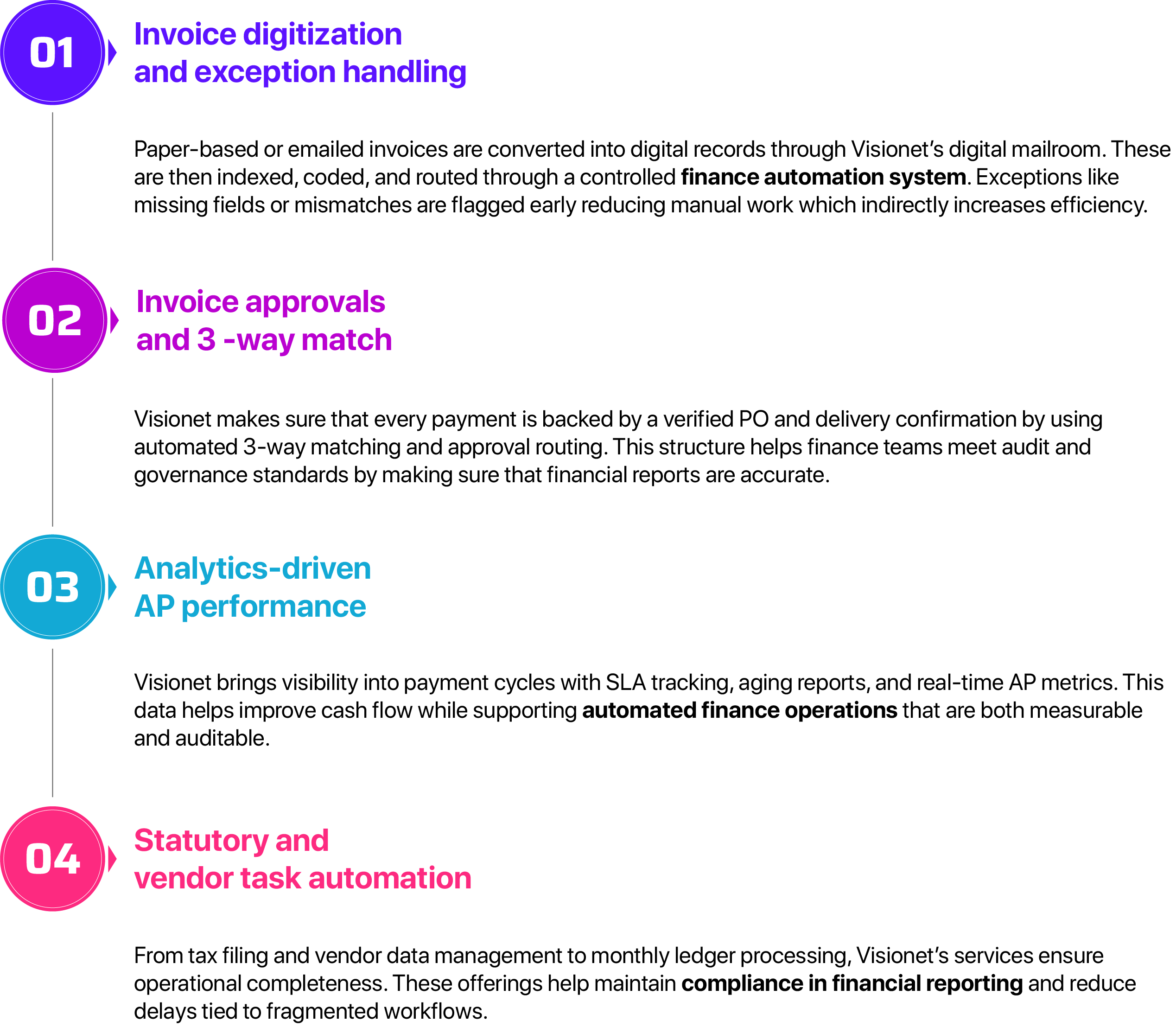

Visionet’s structured approach supports smarter accounts payable automation:

Bringing clarity to the order-to-cash cycle

The order-to-cash (O2C) process has become more important as finance teams try to get better control over working capital. When invoices are late, payments are misapplied, and ledger updates are not connected, it not only slows down cash flow but also makes it harder to audit.

By automating crucial steps from invoice generation to cash application, Visionet assists finance teams in offering the O2C cycle structure and visibility. Accurate revenue recognition and quicker exception resolution are made possible by real-time tracking of receivables, payment status, and ledger balances.

With analytics built into every step, CFOs gain the insights they need to monitor aging receivables, manage disputes proactively, and support compliance in financial reporting. Visionet’s automation-first approach ensures that O2C performance is not just improved but measurable, predictable, and audit-ready.

How Visionet enables faster, audit-ready financial reporting

Due to stricter deadlines, changing regulations, and heightened board scrutiny, financial reporting is now a continuous responsibility rather than a quarterly routine. However, a lot of finance teams continue to work with fragmented ledgers, siloed data, and extensive manual reconciliations, which makes audit preparation difficult and vulnerable to mistakes.

Visionet addresses these challenges by embedding automation and structure across the Record-to-Report (R2R) cycle. From consolidating financial data to managing journal entries and generating statutory reports, Visionet’s solutions reduce the operational lag between transaction and reporting.

How Visionet supports audit-ready reporting at scale

Visionet ensures financial data from multiple systems is standardized, validated, and posted accurately, reducing reporting delays and manual effort.

Built-in templates and controls support statutory filings, sales tax reporting, and audit trail generation ensuring alignment with internal policies and external regulations.

Finance teams can access timely, verifiable data that supports operational and compliance goals with the help of customized dashboards and SLA-based tracking.

Conclusion

Reactive systems and fragmented procedures are no longer viable options for finance executives navigating 2025. In order to help CFOs and their teams meet changing regulatory requirements, produce accurate results, and exercise more control over every financial cycle, Visionet brings structure, automation, and compliance to the core of finance operations.