Visionet announces Anand Sampath’s expanded leadership role overseeing India center operations

Visionet today announced that Anand Sampath, Global Head of Business Process Services (BPS), will take on additional responsibilities overseeing the company’s India center operations.

- Ebooks

Our guide for a successful ERP implementation: Four pitfalls you should definitely avoid when introducing a new ERP system.

“And a results-driven approach to help you do it.”

- White Papers

In today’s data-driven economy, Business Intelligence is more than just a reporting tool; it has become a catalyst for competitive advantage. When aligned with strategic goals, a high-performing BI environment helps organizations uncover hidden value, eliminate inefficiencies, and enable real-time, confident decision-making at every level.

What’s inside?

This white paper offers a practical framework to:

- White Papers

Cloud security isn’t just a priority—it’s a necessity.

As cloud adoption scales, traditional perimeter-based defenses fall short. Our white paper shows how integrating Zero Trust with End-to-End Azure Governance & Managed Services transforms your security posture from reactive to resilient—ensuring compliance, scalability, and proactive risk management. - White Papers

Cloud environments are growing more complex every day. Manual management can’t keep up. Our white paper shows how AI-infused Azure Managed Services transform cloud operations—from reactive firefighting to proactive, automated, and intelligent management.

- Article

Retail is not what it used to be. In Canada, the way people shop has changed fast. Online, in-store, curbside, mobile, it’s all connected now. And for most retailers, keeping up can feel like trying to fix the plane mid-flight. That’s where retail consulting services helps. It’s not just advice, it’s hands-on support to help you make better decisions, adopt the right tech, and make retail less chaotic.

- White Papers

In today’s digital economy, managing hybrid and multi-cloud environments is more than just support—it’s a strategic imperative. Our white paper, “From Cloud to Catalyst: Driving Business Value with Azure Managed Services,” equips you with actionable insights to transform Azure from a platform into a performance powerhouse.

- White Papers

In today’s fast-paced digital landscape, managing Azure cloud environments efficiently is no longer optional—it’s critical for business success. This white paper is your essential guide to mastering Azure Managed Services and unlocking your cloud’s full potential.

- News

[Bangalore– July 1, 2025] Visionet Systems Inc. today announced that Anand Sampath, Global Head of Business Process Services (BPS), will take on additional responsibilities overseeing the company’s India center operations.

This leadership transition follows the departure of Sandeep Agarwal, who played a key role in scaling the India center over the past four years. His contributions have helped establish a strong operational foundation and growth trajectory.

- Case Study

Learn how Visionet empowered a leading optical retailer to modernize its data platform with Microsoft Fabric—driving real-time insights, stronger governance, and AI-ready scalability.

- Case Study

A leading retail and eCommerce brand modernized its IT support by integrating Generative AI, enhancing operational efficiency, and improving user experience.

What’s in it for you?

Discover how we helped the client achieve:

Faster IT support and query resolution – AI-powered virtual assistants to streamline ticket creation, automate queries, and provide instant support, reducing response times.

- Brochure

Intelligent Order Management (IOM) is a transformative solution designed for retailers across industries- including fashion, grocery, and general merchandise. It enables seamless omnichannel order orchestration, ensuring customers enjoy a consistent shopping experience whether they purchase in-store, online, or through call-in orders.

- Event

Join us at the European Power Platform Conference to explore how Visionet enables seamless integration, innovation, and customer-centric digital transformation through Microsoft Power Platform.

- Brochure

AI-powered, activity-level budgeting in SAP—simplified.

Bridge SAP FICO with Microsoft Power Platform to plan, manage, and approve budgets in real time. Designed for finance leaders who need more than spreadsheets, PowerAgent brings live SAP data, Copilot AI, and low-code workflows into an intuitive experience.

Built for smarter budgeting

Live SAP integration

- Case Study

Discover how leading enterprises are transforming with Fabric—faster, smarter, and with measurable value at every stage. This Fabric casebook features real-world, high-impact use cases by Visionet, designed to help you migrate from legacy systems, unify siloed data, and empower intelligent decision-making at scale

- Webinars

Join Visionet and Microsoft for a practical session on how Microsoft Fabric is helping companies break down data silos, unify their systems, and deliver real-time insights that drive real impact.

- Webinars

Break Silos. Elevate Service. Modernize Your Municipality.

Find out how leading cities are revamping public services by disrupting legacy systems and siloed departments. How Microsoft Dynamics 365 Commerce and Visionet's award-winning products and services power frictionless citizen-first experiences-along with profound operation cost reduction. - News

[May 29, 2025] – Visionet, a leading IT services firm, has been recognized with two prestigious honors at The Great Gather Goa Summit 2025. The event, held at the Hilton Hotel in Goa on May 25, was organized by BARC Asia, ERTC Media, and Herald Global. Visionet was awarded both the Best Brands Award and the Marketing Meister Award, marking a significant milestone in its journey of innovation, strategic excellence, and industry leadership.

- Article

With the swift evolution of the digital age, even the most resilient retailers have only two choices, either to evolve or perish. A case that needs to be mentioned in this scenario is that of a British multinational retailer with a robust presence in clothing, groceries, and home goods that owned the space across more than 1,509 stores around the world was at this juncture.

- Event

We’re excited to be at Insurance Innovators USA as a Bronze Sponsor. With over 1,000+ industry leaders attending, this event is all about bold ideas and real-world change.

- Case Study

A leading telecommunications provider enhanced service delivery, operational efficiency, and scalability through automation and integration with Microsoft Dynamics 365.

- Case Study

A top telecommunications provider in the UAE faced challenges with limited scalability, inefficient workflows, and security concerns while transitioning from an on-premises system to the cloud.

Visionet implemented a hybrid cloud solution using Microsoft Dynamics 365 Field Service, ensuring seamless migration, enhanced efficiency, and regulatory compliance.

- Case Study

With over 39,000 employees and $52B+ in annual revenue, a global telecommunications leader faced major operational roadblocks due to manual processes, inefficient resource management, and lack of real-time visibility.

Visionet partnered with them to deliver an end-to-end digital transformation, streamlining order management, lead tracking, and partner collaboration with Microsoft Dynamics 365 CE.

- Case Study

Facing challenges with outdated systems and complex cloud migration? Learn how Visionet empowered a top title insurance provider to modernize its IT infrastructure using Azure Managed Services, achieving seamless business continuity, heightened security, and enhanced operational performance.

- Event

At Field Services Palm Springs, discover how Visionet’s AI-powered Field Service solutions, combined with predictive analytics, automation, and real-time insights, are redefining efficiency, customer satisfaction, and profitability across industries.

- Case Study

Facing data silos, manual reporting, and scalability issues? Discover how Visionet helped a premier luxury jewelry brand modernize its data platform using Microsoft Fabric—achieving real-time analytics, enhanced governance, and a scalable, AI-ready architecture.

- White Papers

A Visionet whitepaper | Discover the framework behind autonomous enterprise intelligence and operations

“The future of enterprise AI is not about smarter assistants. It’s about building organizations that can think, act, and evolve.”

As GenAI becomes widely adopted, a new challenge emerges: How do enterprises evolve beyond prompt-driven AI tools to systems that can act, adapt, and make decisions autonomously and symbiotically?

- Case Study

Struggling with high support volumes, slow response times, and fragmented AI tools?

See how Visionet helped a global retail brand modernize customer service with Generative AI—delivering faster resolutions, smarter automation, and scalable support operations.

- Brochure

Is Your Business Ready for B2B Sales Transformation?

Manual quotations, pricing inconsistencies, and inefficient workflows can slow down your B2B sales process. Visionet’s Customer Quotation Accelerator streamlines your sales process, enabling instant, accurate, and personalized quotations to improve operational efficiency and sales performance.

- Webinars

In our recent webinar, Visionet showcased how AI Agents powered by Microsoft Copilot Studio and Azure AI Foundry help businesses address economic challenges and boost operational efficiency. Our Microsoft expert emphasized that Copilot Studio is more than just a tool—it's a comprehensive UI that integrates AI solutions, streamlines processes, and provides intelligent insights.

- Case Study

Client

A leading fashion group operating multiple iconic brands across diverse markets sought a cohesive KPI framework to improve performance tracking and data-driven decision-making at both brand and enterprise levels.

- News

[Cranbury, NJ, March 18, 2025 – Visionet, a leading IT services firm specializing in digital experiences, enterprise modernization, Data & AI applications, and managed IT services, has announced its elevation to Salesforce Crest Partner status. This recognition highlights Visionet’s continued commitment to delivering cutting-edge Salesforce solutions tailored to its clients' evolving business needs.

- Case Study

Struggling with outdated ERP and operational instability? Discover how Visionet helped a renowned luxury fashion brand modernize its ERP, enhance system stability, and drive digital transformation with Microsoft Dynamics 365—empowering growth, agility, and superior customer experiences.

- Case Study

Discover how a leading global footwear and apparel brand transformed its operations with cutting-edge digital solutions. This in-depth case study reveals how the company overcame complex challenges to achieve seamless integration, enhanced customer experience, and unprecedented business growth.

- News

The recognition highlights Visionet’s commitment to fostering a high-trust, high-performance workplace

[Bengaluru, March 3, 2025] – Visionet Systems, a leading IT services firm, is proud to announce that it has been Certified™ by Great Place to Work® for the 2025-26 year across five key regions – USA, Canada, India, UKI, and Germany.

- Blog

The way people shop, interact with brands, and make purchasing decisions has drastically changed over the past decade. What once required a trip to the store can now be done with a few clicks, taps, or even voice commands.

- Brochure

Take the first step towards transforming your data architecture and unlocking a connected, intelligent ecosystem with Visionet’s Microsoft Fabric assessment and migration.

- Brochure

Transform your ERP systems with Visionet’s data consulting for Microsoft Dynamics 365. Our solutions help streamline data integration, enhance operational efficiency, and drive better decision-making by aligning your data platform with the latest technologies.

- Brochure

Visionet’s 12-Week Fabric implementation on Azure helps your enterprise seamlessly integrate, govern, and analyze your data, empowering your team with real-time insights and streamlined decision-making for enhanced business agility.

- Brochure

Transform your legacy systems into a modern data ecosystem with Visionet’s seamless set up & migration for Azure Synapse.

- Brochure

Are you ready to modernize your data architecture and unlock real-time insights? Visionet’s migration offering allows organizations to transition from Azure Synapse to Microsoft Fabric in just 6-8 weeks, enabling scalable, efficient, and secure data management for improved decision-making.

- Case Study

Client

A leading global retailer with an extensive online and offline presence sought to improve customer engagement and loyalty through AI-driven personalization and predictive analytics.

- White Papers

In today’s fast-evolving business environment, customer service is no longer just about handling issues—it's about delivering exceptional, personalized experiences at scale. Our whitepaper, "Redefining Customer Service: How AI and Automation Drive Smarter Engagement and Operational Excellence," explores how businesses can leverage AI, automation, and real-time analytics to enhance customer satisfaction, reduce inefficiencies, and drive lasting loyalty.

- Brochure

Is your business ready for AI-powered transformation?

Inefficiencies, manual workflows, and siloed processes can hold your organization back. Copilot Agents—Visionet’s AI-powered automation platform—brings intelligence, seamless integration, and rapid deployment to every aspect of your operations.

- Event

Join Visionet at IDC India CIO Summit 2025 to explore how enterprises can transcend the AI experimentation spiral and fast-track Gen AI projects to full-scale deployment.

- Event

Transform your Capital Markets operations with a holistic approach to technology and domain expertise. From ASF reporting, Loan Grading, and Securitization Reporting to Non-QM loans—including RTL, DSCR, Bank Statement Loans—and Conditions Clearing, our expertise ensures accurate and efficient results for your business.

- Case Study

In today’s digital-first world, organizations with legacy IT infrastructures struggle to keep up with increasing demands for efficiency, scalability, and security. A global leader in technical and vocational education, committed to the philosophy of "no learner is left behind" since 1848, faced similar challenges.

- Case Study

Struggling with outdated infrastructure and the complexities of cloud migration? Discover how Visionet helped a leading title & settlement services company modernize its IT environment with Microsoft Azure—achieving faster scalability, improved security, and uninterrupted business operations.

- Brochure

Is your insurance business ready for AI-powered transformation?

Inefficiencies, manual workflows, and data silos can hamper insurers’ efficiency. InsureGen—Visionet’s AI-powered platform—brings automation, intelligence, and seamless integration to claims, underwriting, and customer engagement.

- Brochure

Struggling with slow, error-prone document management in insurance?

Insurance operations are burdened by inefficiencies in document management, leading to delays, errors, and compliance challenges. DocVu.AI—Visionet’s AI-powered automation platform—transforms how insurers handle document-heavy workflows, enhancing efficiency, accuracy, and decision-making.

- Brochure

Is your actuarial process slowing you down?

Repetitive tasks, complex data handling, and inefficiencies can hold back your actuarial operations. With Accel – Visionet’s Actuarial Utilities Platform, you can harness intelligent automation to streamline workflows, enhance agility, and drive measurable efficiency gains.

- News

[Cranbury, New Jersey, February 4, 2025] — Visionet, a leader in digital transformation and technology solutions, has achieved recognition as a Major Contender in Everest Group's PEAK Matrix® 2025 assessments for Data & AI Services for Mid-Market Enterprises and Application Management Services (AMS).

- Case Study

Client:

A global financial services leader based in Boston, offering investment, retirement, and wealth management solutions. The firm leverages advanced technologies to ensure precision, consistency, and informed decision-making, maintaining its industry leadership.

- Case Study

Client:

A top global reinsurance provider offering property and casualty solutions, known for innovation and trusted by insurers worldwide.

- Case Study

Client

The client is a renowned distribution company specialized in disposable products, serving various clients across diverse industries such as healthcare, food service, and hospitality.

- Case Study

A global pharmaceutical leader revolutionized drug discovery by adopting Visionet’s GenAI Studio, accelerating research timelines, boosting operational efficiency, and fostering collaboration across teams.

What’s in it for you?

Discover how we helped the client achieve:

- Event

Discover how a leading lifestyle and fitness brand transforms retail with Microsoft and Visionet, enhancing experiences, optimizing operations, and fueling growth.

- Case Study

A global leader in medical equipment leveraged Visionet’s expertise and Microsoft Fabric to streamline data integration, reduce costs, and accelerate innovation.

- Event

Join Us for an Exclusive Evening in the Heart of NYC. Uncover the transformative journey of a leading lifestyle and fitness brand as they redefine retail excellence. Powered by Microsoft technologies and Visionet’s expertise, discover how innovation is revolutionizing customer experiences, streamlining operations, and fostering sustainable growth. This exclusive event showcases one of the most compelling retail transformation stories of today.

- Ebooks

Visionet's 2025 Data & AI Trends Playbook is a blueprint for businesses determined to leverage the most powerful forces shaping industries today. This report delivers more than just data; it uncovers the strategies, innovations, and technologies that will define the winners of tomorrow.

- Blog

The retail industry is on the verge of a revolution, and Visionet is at the forefront of this journey. As the retail world gathers for the NRF Big Show 2025, Visionet is set to unveil groundbreaking advancements that will redefine how businesses operate, connect with customers, and achieve unparalleled efficiency.

- Case Study

A leading European pharmacy chain modernized its IT infrastructure with Visionet’s Azure Managed Services, achieving faster incident response, improved system reliability, and streamlined operations across its network.

What’s in it for you?

Discover how we helped the client achieve:

- Case Study

Unlock secrets to IT efficiency

Are IT inefficiencies disrupting your business? Learn how Visionet’s Azure-based solutions helped a leading luxury swimwear retailer streamline operations, reduce costs, and achieve near-perfect uptime.

- Ebooks

The cloud is no longer just a tool for efficiency – it’s the driving force behind today’s most groundbreaking innovations. As we approach 2025, businesses are increasingly relying on the cloud to transform how they operate, adapt, and grow. Are you prepared to take advantage of the trends shaping the future?

- Brochure

Are inefficiencies, data silos, and delayed reporting slowing down your IT operations? With Visionet PriXm, you can take charge of your IT support and maintenance processes and transform them into a seamless, unified experience.

- Blog

Q1: Why should businesses consider Visionet for Azure Managed Services?

In the digital era, organizations face challenges like rising costs, scalability issues, and security vulnerabilities. Visionet addresses these with robust cloud management solutions that allow businesses to concentrate on growth while we manage the complexities.

- Blog

In the fast-evolving digital landscape, the cloud is no longer just an option—it’s a necessity. For businesses leveraging Microsoft Azure, the challenge lies in managing complex cloud environments while keeping costs in check and ensuring security.

- Blog

In today’s fast-paced digital landscape, enterprises are increasingly turning to cloud platforms to drive transformation, streamline operations, and accelerate innovation. Microsoft Azure stands as a leading choice for businesses worldwide, offering unparalleled scalability, flexibility, and power. But managing Azure effectively requires expertise, constant vigilance, and tailored strategies.

- White Papers

In a digital-first era, enterprise integrations have become the backbone of operational efficiency and innovation. But keeping pace with evolving technologies can be challenging. Our white paper, "Connecting the Dots: Transformative Strategies for Enterprise Integrations in a Digital-First Era," equips you with actionable insights to future-proof your business.

- Event

Overview

We are excited to invite you to the Visionet AWS New York event 2024, where you’ll immerse yourself in the latest advancements in Generative AI and beyond. This is not just another event—it’s your gateway to exploring the technologies that are transforming industries and empowering businesses to thrive in the digital age.

- Case Study

How did Visionet help a leading benefits administrator cut print and mail costs by 20%?

Are High Print & Mail Costs Draining Your Budget? Discover how Visionet helped a leading Benefits Administrator optimize its print and mail operations, reducing costs by 20% and driving long-term efficiency.

- News

[Cranbury, New Jersey and Berlin, Germany, November 5, 2024] – Visionet Deutschland GmbH, a subsidiary of Visionet Systems Inc., has announced the acquisition of Rödl Dynamics GmbH. Rödl Dynamics GmbH is an affiliate of Rödl & Partner, one of the largest auditing and consulting firms in Germany.

- Blog

Thanksgiving is not only a time for family gatherings and reflection but also signals the start of one of the most critical retail periods of the year. Traditionally, it kicks off the holiday shopping season in the United States, with Black Friday and Cyber Monday following closely behind. During these six weeks, a significant portion of retail sales takes place, making it crucial for retailers to prepare strategically.

- Ebooks

As businesses evolve in an increasingly digital world, harnessing the power of data becomes crucial to staying competitive. Salesforce Data Cloud (formerly Salesforce Customer 360 Data Cloud) is the leading platform to centralize, manage, and leverage customer data for real-time insights, personalized experiences, and seamless business operations. By 2025, its adoption will be a game-changer for businesses across various industries.

- Case Study

Reimagining mortgage processing with AI and automation

A leading U.S. mortgage lender streamlined operations, reduced turnaround times, and cut costs by 40% with Visionet’s AI-powered transformation.

- Brochure

Is your utility business prepared for the future? Imagine a world where your equipment tells you when it needs maintenance, where your field teams are dispatched automatically based on real-time data, and where service disruptions are a thing of the past. With VisiConnect360, that future is now.

- Brochure

Looking to take your field service operations to the next level? VisiField 360 is the solution you’ve been waiting for. Seamlessly integrated with Dynamics 365 Field Service, this cloud-based platform empowers you to streamline operations, boost technician productivity, and deliver superior customer experiences—all while reducing operational costs.

- Brochure

What if you could streamline every aspect of your facility management, from work orders to inventory, with just one cloud-based solution? Meet VisiDepot, the game-changing tool built on Dynamics 365 Field Service, designed to revolutionize your operations and elevate your customer experience.

- White Papers

In today’s fast-paced, data-driven world, Customer Data Platforms (CDPs) are revolutionizing how businesses harness customer insights. Our latest whitepaper delves into the transformative impact of CDPs, which unify customer data into a single source of truth. By offering a 360° view of customer interactions, CDPs empower businesses to deliver personalized experiences, enhance customer loyalty, and drive growth.

- Event

Empowering Your Enterprise App Ecosystem with AI-Driven Innovation and Efficiency

In today’s fast-paced digital landscape, driving business outcomes demands more than just technology—it requires innovation and strategic foresight. At Visionet, we leverage Fabric and Co-Pilot to transform your operations with AI-driven solutions that scale with your needs.

- Event

Unleash the full potential of Microsoft Power Platform and supercharge your business growth with Visionet’s Center of Excellence and Copilot experience. Empower your team to craft end-to-end, AI-infused solutions that ignite innovation, boost efficiency, and slash operational costs in record time.

- Case Study

Client:

Y Hata & Co., Ltd. is Hawaii's largest family-owned food service distributor, serving restaurants, hotels, schools, and healthcare facilities. With over a century of experience, Y Hata offers a wide range of high-quality products, including fresh produce, meats, seafood, and dairy, sourced from trusted suppliers. Their commitment to exceptional service, reliability, and innovation has made them a leading player in Hawaii’s food service industry.

- Case Study

How Edwards Garment transformed operations and customer insights with Visionet and Dynamics 365

Battling inventory bottlenecks, disconnected workflows, and blind spots in customer data? Discover how Visionet helped Edwards Garment, a leading uniform manufacturer, transform its operations with Microsoft Dynamics 365 Finance & Operations—achieving seamless integration, real-time visibility, and improved customer service.

- News

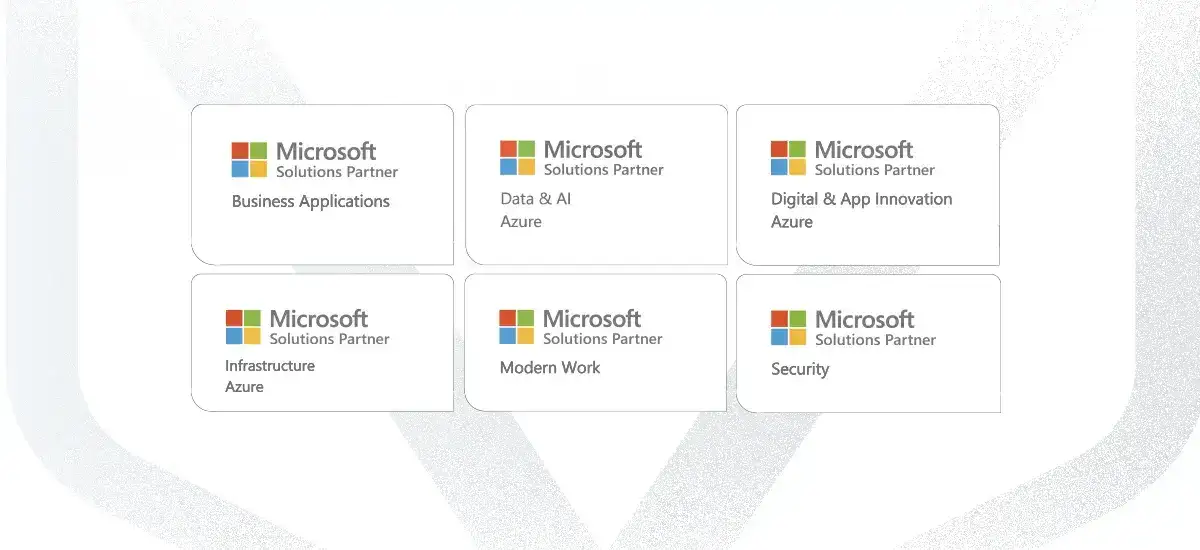

We are proud to announce that Visionet Systems Inc. has achieved all six Microsoft Cloud Partner Program Solution Designations. These prestigious recognitions highlight our expertise and commitment across a broad spectrum of Microsoft technologies. Here’s a closer look at what each designation means:

- News

Alkira’s Network Infrastructure on Demand strengthens Visionet’s global IT solutions portfolio

- News

CRANBURY, N.J., August 27, 2024 – Visionet Systems Inc., a leading IT services company, proudly announces its participation as Empowerment Experience Sponsor at the Power Platform Community Conference (PPCC) 2024, held from September 18-20, 2024, at the MGM Grand in Las Vegas.

- Ebooks

Our ebook, "The Critical Role of Intelligent Process Automation in Insurance," dives deep into the transformative impact of IPA across the insurance sector. Here’s what you’ll discover inside:

- Case Study

How Visionet transformed underwriting efficiency with intelligent automation for faster, more accurate processing?

Facing delays and errors in underwriting? Discover how Visionet helped a leading insurance services company transform its underwriting operations with intelligent automation—enhancing accuracy, reducing delays, and improving overall efficiency.

- Case Study

Business Overview

A leading specialist insurance company, operating across Europe, the US, and the Pacific, offers services in professional indemnity, property, marine, and more. They faced inefficiencies in their Credit Control team’s monthly reporting, which was manual, time-consuming, and error-prone.

- White Papers

Are you ready to unlock new levels of innovation and efficiency in your industry? Our latest white paper reveals how Generative AI (Gen AI), powered by Amazon Web Services (AWS), is revolutionizing the retail, pharma, & BFSI sectors. Learn how Visionet leverages AWS to address specific industry challenges and drive transformative outcomes.

- News

CRANBURY, N.J., July 31, 2024 /-- Visionet Systems Inc, a leading provider of technology services and solutions, is excited to announce a comprehensive rebranding that encapsulates its evolving identity, mission, and values. This strategic transformation signifies the company's continuous evolution and unwavering dedication to exceeding customer expectations.

- Brochure

Many organizations undervalue the influence of Customer Relationship Management (CRM) on the supply chain of a business. Making accurate forecasts, predicting consumer behavior and analyzing customer data can all significantly boost your bottom line.

- White Papers

Traditionally, the insurance industry has been slow to adapt to technological advancements due to its risk-averse nature, reliance on legacy systems, and regulatory complexities. Gen AI offers significant growth potential by optimizing workflows without drastic changes. To ensure ROI and reduce friction, insurers must identify key use cases and strategies to mitigate risks.

The major challenges insurers face are

- White Papers

In the fast-evolving world of healthcare, managing and extracting valuable insights from vast amounts of data is more critical than ever. Our latest white paper delves into how cutting-edge Generative AI technologies can revolutionize the way healthcare organizations handle data.

What you will discover?

1. Transformative AI capabilities

2. Improving patient outcomes

3. Reduced denials with automated claims management - Webinars

In this insightful webinar, industry experts from Visionet and GoSure.AI discussed the transformative power of AI and generative AI technologies in the insurance sector. This session explored how these advanced technologies are being applied across various segments of the insurance industry, including policy servicing, claims processing, marketing, actuarial science, and pricing.

- Case Study

Fortifying cybersecurity for a global inventory solutions leader

Visionet strengthened security operations with Azure Sentinel, enhancing threat detection, response, and infrastructure visibility.

- Case Study

Client:

Rockler, a leading multi-channel retailer based in Medina, Minnesota, has been providing high-quality woodworking and hardware products since 1954. Their customers include hobbyists, DIY enthusiasts, and professional woodworkers.

- Event

Annually, the Collision Conference attracts the brightest minds in the tech space, offering an unparalleled platform to unveil pioneering technologies and to forge global business alliances. This year, Visionet is proud to be attending the conference,that is recognized as one of the premier tech gatherings globally. Collision serves as an ideal forum for highlighting innovative solutions and networking with industry stalwarts.

- News

MISSISSAUGA, ON, June 11, 2024 - Embarking on an exciting journey of innovation and collaboration, Visionet Systems Inc, a leading provider of technology services and solutions, proudly announces its participation in Collision 2024.

- Ebooks

Reimagine claims processing, personalize products, and streamline underwriting

The insurance industry stands at a crossroads. Traditional methods struggle to keep pace with evolving customer demands and a dynamic marketplace. However, a revolution is brewing, fueled by the transformative power of Gen AI.

- Ebooks

In today's highly competitive environment, data is not merely a resource; it serves as the vital essence of organizations. Enterprises are harnessing data to enhance efficiency, cut costs, expedite innovation, and enhance decision-making processes.

Having said that, traditional data platforms have their limitations when it comes to handling the influx of data from diverse sources.

- Webinars

Discover how Microsoft Power Platform and Copilot can transform your business operations and elevate your employees' experience. Power Platform is more than just a suite of applications—it's a catalyst for innovation and efficiency. With tools like Power BI, Power Apps, Power Automate, and Copilot Studio, you can build custom apps, automate processes, and analyze data for insights.

- Webinars

Welcome to our webinar on unlocking the potential of Dynamics 365 and PartnerLinQ!

In the ever-evolving world of business, staying ahead means finding innovative ways to enhance efficiency and collaboration across various enterprise solutions. Watch our on-demand webinar to explore how Dynamics 365 and PartnerLinQ revolutionize your organization’s operations and drive success in today’s dynamic landscape. - Event

This year, at Salesforce Connections 2024, unlock the power of Salesforce ecosystem and AI with Visionet to revolutionize Customer Experiences, Cultivate Deeper Connections, Innovate Commerce, and Supercharge Marketing.

- Case Study

Optimizing cloud scalability and automation with AWS

A leading in-home accommodations platform enhanced system scalability, automated deployments, and reduced operational costs with Visionet’s AWS cloud solution.

- Case Study

Client

Al Baker Group, a leading business conglomerate in Qatar, operates across healthcare, FMCG, and real estate. Since the 1940s, it has remained a key player in the GCC region, delivering innovative solutions.

Challenges

With a rigid on-premises infrastructure limiting scalability and efficiency, Al Baker Group sought a seamless Azure migration to enhance performance, security, and innovation.

- Case Study

Transforming cloud operations: Enhancing performance and security for Atrium

Struggling with cloud disruptions, security challenges, or infrastructure inefficiencies? Discover how Visionet helped Atrium, a leading workforce solutions provider, overcome persistent cloud failures, latency issues, and security risks through a refactored AWS migration—ensuring stability, scalability, and seamless operations.

- News

CRANBURY, N.J., May 1, 2024 - Visionet Systems Inc, a global leader in technology services, is thrilled to announce its strategic alliance with Actuarial Resources Corporation (ARC), a renowned actuarial software and consulting firm. This collaboration marks a significant milestone in Visionet's commitment to delivering cutting-edge technology solutions for the insurance industry.

- Case Study

Elevating retail innovation with DevSecOps

A leading luxury fashion brand enhanced its development lifecycle and deployment efficiency with Visionet’s Enterprise DevSecOps platform.

- Event

In a time when service industries are changing quickly, innovation is more essential than ever. Traditional service models are being challenged by inefficiencies in scheduling, low first-time fix rates, and underutilization of valuable data. At Field Services Palm Springs, we invite you to explore how AI-enabled capabilities and Microsoft Field Service Solutions can transform your operations and elevate customer satisfaction to new heights.

- Ebooks

Reduce Costs, Accelerate Drug Discovery, and Improve Patient Care

Lifesciences companies are facing immense pressure to develop new drugs faster and at a lower cost. Traditional methods are no longer sufficient. Our Gen AI solutions empower life sciences businesses to achieve breakthrough results through:

- Ebooks

Reimagine Customer Experiences, Optimize Operations, and Drive Growth

The retail industry is on the cusp of a transformative era driven by the power of Gen AI. Here’s how Visionet, a frontrunner in this revolution, delivers cutting-edge Gen AI solutions that address the intricate challenges of today's retail landscape:

- White Papers

In today's digital age, businesses face the constant challenge of efficiently extracting valuable information from vast amounts of documents. Traditional methods often prove time-consuming, error-prone, and resource-intensive. However, with the emergence of Gen AI, a new era of Intelligent Document Processing (IDP) has dawned, promising unparalleled accuracy, speed, and adaptability.

- Webinars

Service industries are changing fast, and they need to be innovative. Old service models are struggling with problems in resource scheduling, poor fix rates, Reducing Operational Costs and gather data via unified ecosystem to enable AI based service personas.

- Brochure

In the vibrant world of modern healthcare, personalized care stands as a testament to patient satisfaction and improved outcomes. Visihealth 360 leverages Salesforce’s Health Cloud to revolutionalize and create superb patient experiences with streamlined operations and enhanced care delivery.

- Case Study

AI-driven data modernization for a biotech leader

A leading biotechnology company enhanced data management and accelerated drug discovery by implementing Visionet’s AI-powered data solutions.

- Case Study

Facing scattered data silos and labor-intensive reporting processes? Discover how Visionet helped a leading US medical aesthetics manufacturer transform data management with an AI-driven Modern Data Platform—enabling automated insights, self-service reporting, and faster, data-driven decisions.

- Case Study

Struggling with outdated data infrastructure and rising operational costs?

See how Visionet helped a leading retailer modernize its data warehouse with AI-powered automation, delivering faster data processing, real-time insights, and improved cost efficiency.

- Case Study

Transforming insurance data ecosystems with Visionet’s AI-driven platform

Discover how Visionet empowered a prominent insurance firm to redefine its data management strategy through cutting-edge AI and cloud technologies.

- White Papers

Explore the Future of Insurance Underwriting and Customer Experience with Our Latest White Paper

- White Papers

In today’s dynamic digital landscape, customer service plays an important role in shaping customer loyalty and brand perception. As customers become tech-savvy, their demands and expectations for a seamless and personalized customer service have increased unprecedently. To stay relevant, businesses should adopt solutions that amplify the customer experience.

- News

This collaboration will reshape and revolutionize the digital landscape of the insurance industry and makes our clients trailblazers in adopting AI to drive growth and efficiencies.

- Case Study

A leading pharmaceutical company faced challenges in streamlining data from multiple sensor devices provided by different manufacturers to measure drug efficacy. Visionet proposed an intelligent sensor data platform that standardized analytical schema, provided an ingestion layer for variety of sensors and an AI framework.

- News

15th March, [Bangalore] - Visionet Systems Inc, a premier provider of technology services, proudly announces a strategic partnership with Algomox, a distinguished leader in AIOps platforms, aimed at revolutionizing Cloud Management. This collaboration, facilitated by VisionTechFest's TechStart, underscores a mutual commitment to fostering innovation and collaboration in Cloud and Infrastructure Management.

- Event

The underwriting process has significantly evolved from a largely manual and intuition-based practice to a sophisticated, data-driven approach. Technological advancements, especially in areas like big data analytics and AI, have enabled underwriters to analyse vast and complex data sets, leading to more accurate risk assessments and pricing.

- Case Study

Client

The client is a leading global luxury apparel and accessories brand best known for creating elevated yet understated pieces for every day effortless style.

Challenges

In recent years, the client encountered recurring ransomware attacks. They lacked a centralized log management platform and had never subjected their infrastructure to penetration testing. Moreover, due to a shortage of qualified IT personnel, the client couldn’t review security events.

- Case Study

Client

The client, headquartered in North America, is a prominent pharmaceutical company.

- News

CRANBURY, N.J., February 27, 2024 -- Visionet Systems Inc, a premier provider of cutting-edge technology solutions and services, is thrilled to announce its inclusion in CRN®'s Managed Service Provider (MSP) 500 list for 2024.

- News

London, UK, March 04, 2024 -- Visionet Systems Inc, a global technology solutions company, announces its participation as a silver sponsor at Insurtech Insights, Europe’s largest Insurtech conference, on March 20th and 21st, 2024. Held at the InterContinental London - The O2, the event will serve as a platform for Visionet to showcase its AI-driven solutions transforming the insurance industry.

- Brochure

PartnerLinQ is an innovative, process-centric, easy-to-use solution that simplifies digital business communication via EDI, real-time APIs, and proprietary file-based formats. It helps retail, eCommerce, wholesale, 3PL, distribution, and other progressive organizations build digital partner ecosystems, achieve operational efficiency, bring transparency and gain real-time visibility.

Our top features:

- Webinars

Watch our on-demand webinar that unveils the future of business operations and customer engagement through the lens of AI innovation. We’re excited to discuss the extraordinary capabilities of Microsoft Copilot Studio in enhancing the Power Platform adoption, marking a new era in the digital landscape.

- White Papers

In today's rapidly evolving business landscape, enterprises are under constant pressure to innovate, enhance productivity, and achieve operational excellence. This white paper delves into the strategic implementation of a Power Platform Center of Excellence (CoE) within organizations. This comprehensive guide elucidates the critical components of the Power Platform suite, emphasizes the significance of a CoE, and delineates strategies for effective governance, training, and measuring ROI.

- Event

Don’t miss the opportunity to attend the premier annual event for service professionals and providers in Orlando. Visionet’s business transformation services combine human and digital elements to achieve non-linear scalability and improved customer experience resulting in tangible business outcomes.

- Case Study

Client

The client is a prominent retail player specializing in mattresses and accessories and has over 2,400 stores across the US.

- Case Study

Client

The client is a prominent retail player specializing in mattresses and accessories and has over 2,400 stores across the US.

- Case Study

Explore enhanced research experiences with Visionet & Google Cloud. AI-driven video summaries ensure effortless discovery and personalized recommendations.

Client

The client provides platform and software services to help researchers and academic institutions create, manage, and share scientific and academic research content.

- Case Study

Explore how Visionet, with Google Cloud Platform, revolutionized content for a research provider. Our AI-driven solution ensures accurate information retrieval and establishes trust in the research community.

Client

The client offers platform and software services to help researchers and academic institutions create, manage, and share scientific and academic research content.

- Case Study

Client

The client is a leading player in the business of specialty mattresses in the US and has over 2,400 stores spanning across 49 states.

- Case Study

Client

The client is one of the largest retailers specializing in mattresses and accessories and has over 2,400 stores across the US. Committed to delivering exceptional customer experiences and ensuring continued industry dominance, they aimed to enhance their reporting and automation capabilities by revamping their vendor reporting system.

- Case StudyRevolutionizing Artifact Deployment: A Google Cloud-Powered Transformation for a Leading US Retailer

Client

The client, a key US retailer specializing in specialty bedding and mattresses, aimed to optimize artifact deployment to increase operational efficiency.

- Case Study

How Visionet transformed customer experience with data-driven insights for a leading retailer?

Facing challenges with disjointed customer data and unlocking actionable insights? Discover how Visionet helped a major US retailer in the mattress and accessories industry transform its customer experience with Google Cloud technologies—unlocking a 360° customer view, streamlining data analytics, and driving personalized engagement.

- Case Study

Client

The client is a key US retailer with more than 2,400 stores engaged in the business of specialty bedding and mattresses. The company was looking forward to boosting its competitive edge through strategic pricing.

Challenge

Over the years, the company has encountered obstacles in tailoring an effective pricing strategy that is fine-tuned with the ever-changing market conditions and competitor offerings.

- News

Pittsburgh, PA, January 24, 2024 /-- Visionet Systems, a leading provider of IT consulting and services, announced the opening of a new office in Pittsburgh, exclusively dedicated to serving AtClose customers, a Visionet Company. AtClose is renowned for its expertise in the lending business, offering innovative solutions to clients in the title and settlement industry.

- Event

Join us for an insightful and delectable co-hosted dinner event featuring industry experts from Microsoft, Adyen and Visionet. Immerse yourself in the latest trends, best practices, and success stories surrounding AI Innovation in Commerce, as shared by experts from Adyen, Visionet, and Dynamics 365 Commerce customers.

- News

Leading the Way in Integrated Digital Supply Chain Transformation

- Brochure

Microsoft Dynamics 365 Warehouse Management solution revolutionizes warehouse operations with seamless integration across manufacturing, sales, and transportation. With Visionet Systems expertise of implementations businesses can employ advanced technologies like barcode scanners and RFID for precise inventory tracking. Key functionalities include efficient wave processing for order fulfillment, directed put-away and picking for accuracy, and mobile device support for on-the-go operations.

- News

The award for Visionet's Digital Infrastructure Transformation Project recognizes the company’s forward-thinking strategies in navigating the dynamic realms of technology

- News

CRANBURY, N.J., December 4, 2023 /-- Visionet Systems, a leading technology solutions provider, hosted a webinar on how to accelerate Power Platform adoption with its Center of Excellence (CoE). This strategic offering was aimed at propelling innovation, fostering low-code development, and streamlining governance processes within organizations by eliminating geographic and company-wide silos.

- Webinars

In today’s dynamic business landscape, customers seek personalized and seamless experiences tailored to their needs and ever-evolving preferences. This is where Generative AI comes into play.

In our recent webinar, experts from Visionet and Salesforce highlighted the immense power of integrating AI, Data, and CRM while uncovering endless possibilities of Generative AI. This webinar provides a comprehensive breakdown on: - Brochure

Leverage Visionet CloudOps and AWS Cloud Operations to enhance efficiency through optimized cloud resources, reducing operational costs. Our automation-centric approach frees your IT team for strategic initiatives, elevating overall cloud excellence. We guarantee the seamless continuation of your processes, even in challenging cloud scenarios. Moreover, our partnership speeds up your time-to-market, enabling the swift introduction of cloud innovations.

- White Papers

In today’s dynamic business environment, the importance of effective Governance, Risk, and

- Brochure

At Visionet, we understand the complexities of this transformation. As the Microsoft Solutions Partner, we leverage Microsoft Cloud for Sustainability to help you attain carbon footprint reduction in three simple steps — encompassing everything from capturing to tracking GHG emissions:

- Envisioning

- Pilot

- Rollouts

- Case Study

Is outdated infrastructure holding you back? Struggling to scale and ensure optimal performance? Discover how Visionet helped a leading EMEA telecommunications provider modernize its applications with an on-premises microservices architecture—boosting user engagement, minimizing downtime, and empowering the platform for sustainable growth.

- PodcastIn our first episode of VisionCast, Will Vinton, Sr. Director, Head of Digital Consulting with Tauseef Muhammad, VP & Head of Marketing, had a candid conversation and revealed the key trends that will benefit retailers of all sizes in 2023 and what business and technological shifts are required. Explore key trends such as customer-centric shopping journeys, seamless experiences, and a blend of online and in-store shopping that will shape the future of the retail industry.

- PodcastConsumer purchasing behavior continued to rapidly change. Customers now expect seamless experiences across the buying lifecycle and one of the crucial aspects is faster order fulfillment.

- Webinars

In today’s fast-paced business landscape, establishing a Center of Excellence (CoE) isn’t just a choice; it’s a strategic imperative. As industries evolve and technology advances, the need for proactive governance, nurturing organizational growth, hyper-automation, and digital empowerment has never been more pressing. Visionet’s CoE isn’t just a framework; it’s the cornerstone upon which businesses build resilience, innovation, and unparalleled success.

- White Papers

A Top-Down Approach to Successful DataOps Adoption

Embark on a seamless journey to embrace a true DataOps culture with Visionet’s comprehensive white paper. This guide is essential for organizations striving to unlock the full potential of data and transform their digital footprint, thus ensuring a modernized, efficient, and innovation-driven approach to data management.

- Event

While navigating the complex digital landscape, businesses grapple with the pressing challenges of customer satisfaction, swift time to market for solutions, and cost reduction. These concerns, alongside obstacles like delayed modernization and departmental silos, underscore the need for immediate action, making the quest for digital excellence more essential than ever.

- White Papers

Overview:

Delve into The Rise of Actuarial Automation: How Technology is Transforming the Insurance Industry, a compelling white paper that unfolds the transformative potential of intelligent automation technologies within the actuarial domain.

- Webinars

Artificial Intelligence (AI) is one of the prominent and influential topics in the SEO industry, and we’re here to equip you with the essential insights, separating fact from fiction.

- Webinars

Businesses now face a host of challenges as they embrace or transition to Google Analytics 4. The shift brings several challenges that must be effectively addressed to harness the full potential of this cutting-edge platform. Some of your challenges may include:

- Event

Meet Visionet experts at an insightful gathering that unlocks the boundless potential of intelligent automation. At this two-day event, you will find yourself at the crossroads of innovation, exploration, and future of work.

Be part of a vibrant convergence of industry experts, esteemed partners, visionary technologists, and forward-thinking leaders. Get to know about the transformative impact of intelligent automation on the business landscape. - Brochure

Discover how we craft digital experiences tailored for today and ready for tomorrow’s challenges. At Visionet, our multi-tiered approach speeds up development with Microsoft Power Platform and Copilot. Leveraging our 15+ years of strategic partnership with Microsoft, we assist businesses in rapidly crafting proof of concept within hours and delivering production-ready apps in days.

- Brochure

In this brochure, you'll learn about a structured approach to Generative AI adoption covered in our workshop. From assessing current capabilities to envisioning the future roadmap, this workshop will uncover our proven methodologies and best practices in 3 phases.

- Brochure

In this brochure, you’ll learn about FashionGPT, the AI fashion assistant reshaping retail. It offers unmatched personalization and trendiness. Imagine a world where every shopper feels like they have their own personal stylist, providing tailored style recommendations, curated product selections, and real-time trend alerts, all at their fingertips.

- Brochure

Did you know?

Organizations adopting Dynamics 365 for Field Service witnessed remarkable improvements over three years:

- 60% fewer maintenance hours

- 10% reduced dispatch

- 50% less travel time

- 20% fewer service calls

- Brochure

In this brochure you will learn about VisionServe360° - Visionet's signature approach that ensures your IT team aligns seamlessly with core business objectives, harnesses an unmatched spectrum of technical expertise, and delivers exceptional service anchored in proven best practices.

Moreover, this brochure covers:

- Case Study

Struggling with siloed data operations and inefficiencies?

Discover how Visionet helped a leading biotech company establish a true DataOps culture—eliminating incidents, reducing costs, and enhancing agility.

- Case Study

Redefining e-commerce for Marks & Spencer

Marks & Spencer revolutionized its embroidered school uniform eCommerce platform with Visionet’s Microsoft Dynamics 365 Commerce implementation, enhancing scalability, efficiency, and customer experience.

- Case Study

The Client

A leading news organization needed to enhance the performance of its election results platform to handle surging traffic and deliver real-time updates during major elections. With the 2020 Presidential Elections approaching, ensuring a seamless, responsive, and future-ready platform was critical.

- Case Study

Visionet's solution automated tasks, enhancing productivity and accuracy of actuarial operations.

The client engaged with Visionet to boost efficiency. Visionet's Actuarial Automation Solution was tailored to the specific needs of the insurance company. The solution integrated seamlessly into the existing workflow using industry-standard technologies and tools.

- Case Study

Consolidating fragmented data into a 360° customer view for a leading insurer

Finding it hard to turn scattered data into real customer insights? Discover how Visionet helped a leading insurer consolidate fragmented data into a single, trusted source—delivering a 360° customer view, smarter analytics, and stronger upselling opportunities.

- Brochure

Visionet's 8-week Accelerated Power Platform Adoption with Center of Excellence Enablement Workshop can help you get there! In this brochure, you'll delve into the unparalleled value of this workshop, designed to unfold the massive potential of Microsoft's Power Platform suite.

- Case Study

Looking for a competent eCommerce partner to help them revitalize their eCommerce site performance, a leading retailer in the U.S leveraged Visionet’s end-to-end digital consulting services. This collaboration enabled the brand with next-generation mobile experiences, optimized organic search visibility, and improved impressions.

- White Papers

To manage IT GRC effectively, organizations need to understand emerging technologies like cloud computing, blockchain, IoT, and AI and have a proactive and flexible approach to ensure IT operations’ security, dependability, and compliance.

- White Papers

Are you keen to gain insights into maximizing value and efficiency on AWS? Are you looking for a comprehensive guide that offers strategies for cost optimization driven by DevOps? Look no further.

This white paper will shed light on important aspects such as:

- The AWS Revolution

- Rethinking Cloud Financial Management

- Unlocking Cost Optimization with DevOps

- Best Practices for AWS Cost Optimization

- White Papers

Step into the future of business transformation with our latest whitepaper. This comprehensive guide uncovers how your business can harness the power of Generative AI and Salesforce, by leveraging our expertise to drive business growth.

- Case Study

To overcome the obstacles posed by its outdated legacy system and enhance its commercial operations, the world's largest spinner of pure wool and wool blend yarns, Südwolle Group, turned to Visionet for a comprehensive solution. And Visionet successfully delivered!

- Case Study

Client

A leading member organization in the retail real estate industry, seeking to address operational inefficiencies and enhance user experience for event management. The client partnered with Visionet to revolutionize its event registration, payment processing, and overall digital transformation.

- White Papers

This white paper provides insights on how modern organizations can harness the power of Microsoft Power Platform to streamline their processes, enhance productivity, put innovation in the hands of more of its employees, and achieve sustainable growth in the digital era.

- News

Cranbury, [July 19, 2023] - Visionet, a global leader in technology solutions and services, announced that Kamran Ozair has been appointed Chief Executive Officer (CEO). Kamran, previously served as Head of Strategy and Global Horizontals at Visionet, and brings a wealth of experience and a proven track record of success in the IT services industry.

- Case Study

HauteLogic resolves supply chain complexities by implementing end-to-end supply chain visibility.

- Case Study

Client

A global British retailer with 1,509+ stores aimed to expand its school uniform eCommerce business and reach £1 billion in UK revenue but faced legacy system limitations.

- White Papers

The digital tide is shifting rapidly; customers now demand personalized and consistent experiences across all commerce channels. Siloed operations and fragmented communication further hinder organizational efficiency and limit success. To achieve success in connected commerce, organizations must align their sales and marketing efforts.

- Case Study

An in-depth case study on a leading mattress & bedding accessories retailer A leading mattress and bedding retailer struggled to efficiently store, manage, and interpret customer data, hindering its business growth and affecting customer satisfaction. Despite having a steady influx of website visitors, its conversion rates were not up to par. To improve its conversion rates and provide enhanced shopping experiences, it

- Brochure

Discover how Visionet Managed Analytics Services can empower your business decisions and supercharge your operations. Get to know our unique blend of cutting-edge technology and industry expertise.

Explore our proven pillars of success that are all geared toward increasing revenue and operational efficiency:

- Brochure

As Windows 2012 edges towards its end-of-life (EOL) stage, businesses face potential vulnerabilities such as security risks, non-compliance, and operational disruptions. Visionet offers a robust support suite designed to secure your system and guide you smoothly through this transition.

- Case Study

Client

A globally recognized lingerie brand, known for designing apparel tailored to fuller bust sizes, sought to expand its organic presence in the UK and US markets while improving SEO performance and revenue growth.

- Event

Did you know that 96% of unhappy customers won’t complain, but 91% of them will just leave a brand? Moreover, 80% of companies believe they deliver superior CX, while only 8% of customers believe they are receiving a great customer experience?

- News

IT Solutions provider Visionet helps woodworking retailer streamline its eCommerce infrastructure for enhanced insights and customer service.

- PodcastIn this episode, we will explore the importance of multi-enterprise connectivity in building resilient and sustainable supply chains.

- Event

Businesses need solutions that are ready-to-install and easy to customize with a unified architecture. Salesforce has created powerful ecosystems based on Industry clouds with these capabilities. However, finding the right partner to drive these solutions in a way that maximizes value can be a challenge.

At Connections 2023, you’ll get to experience the power of multi-cloud implementation and support with Visionet!

- White Papers

How do businesses strike the right balance between captivating content, keyword optimization, and user experience? How can they measure the effectiveness of their SEO efforts and make data-driven decisions?

These challenges require careful consideration and a strategic approach.

This whitepaper explores the essential metrics and KPIs that businesses should track to measure the success of their Managed SEO Services, including:

- Event

Dr. Tariq Khan is an enterprising AI leader with multidisciplinary subject matter expertise. Dr. Tariq has used AI to catalyze the transformation of processes for Fortune 500 companies; achieving returns on investment totaling over one billion dollars. He has proven experience of leading AI transformations, with one standout being the establishment of a 5-year AI COE for a Tier 1 Life Sciences company headquartered in New York.

- Case Study

Visionet revamped a Fortune 500 insurer's data platform for optimized performance and costs and improved data management.

- Event

With growing volumes in the Mortgage Secondary market, it is increasingly important to ensure that underlying loans are of high quality. Third party review solutions play a crucial role in elevating due diligence and mitigating associated risks.

- Webinars

Are you ready to harness the power of Artificial Intelligence (AI) in your SEO strategy and drive impactful results?

The rapid advancement in AI technology is changing the field of Search Engine Optimization. AI is not only making it easier to find relevant information but also helping businesses optimize their site for better visibility while driving more qualified traffic.

- White Papers

Implementing AI and IoT-driven solutions can help companies optimize their field service operations. Visionet’s innovative microsoft-powered field service tools VisiField, VisiConnect and VisiDepot are AI-driven solutions that can enhance operational efficiency and customer satisfaction while simultaneously reducing costs and environmental impact.

- White Papers

In this whitepaper, you'll discover the importance of a Salesforce Commerce Cloud CoE for achieving high ROI and driving success. You'll also learn about the benefits of a CoE, including:

- Improved ROI

- Streamlined implementation

- Enhanced scalability

- Increased adoption/satisfaction

- Continuous optimization/innovation

- Case Study

Our client is a global medical device company based in Massachusetts, specializing in manufacturing aesthetic and medical lasers for various treatments. It operates in over 130 countries, providing training, support, and resources to medical professionals.

- Event

Customers have increasingly high expectations from retailers, CPG companies and manufacturers. With global supply chains becoming ever more complex, end-to-end systems that unlock oversight and deliver matchless customer experiences are a must.

Accurate insights, useful data and agile IT frameworks are what businesses need to continue to delight their customers. Yet, knowing where to start can feel daunting.

- Ebooks

Reducing Operational Overheads, Minimizing Data Downtime, and Driving Continuous Improvements

As businesses rely more on data to make informed decisions, effective data management becomes crucial. DataOps is a contemporary solution that helps organizations tackle this challenge.

Visionet DataOps Framework

Visionet offers a comprehensive DataOps framework that helps organizations transform their data operations management.

- Case Study

Client

A multi-billion-dollar home goods retailer with 2,500+ stores across the U.S. sought to optimize data operations and eliminate inefficiencies caused by siloed teams, manual processes, and a lack of standardized workflows.

- Case Study

Client

A multinational telecom company headquartered in Norway, providing mobile and fixed-line telecommunication services to over 180 million customers across 9 countries in Europe and Asia.

- Brochure

Discover Visionet’s innovative and award-winning Managed SEO Services in this exclusive brochure. It is packed with valuable insights and actionable advice on elevating your online presence and achieving unparalleled success.

By downloading our brochure, you will:

- White Papers

Embrace the cloud with confidence by learning about Microsoft's Azure Migration and Modernization Program (AMMP) in this insightful white paper. Learn the strategies for overcoming common cloud migration challenges, maximizing the benefits of cloud adoption, and ensuring a seamless and secure transition.

- Event

Facing downtime and productivity issues due to a shortage of technicians and high demand for services? Have communications become tougher to manage? Are data and records management a PST problem?

- Case Study

Client

A top UK specialty insurer sought a flexible, low-code solution to modernize underwriting, financial control, and share dealing. Legacy systems caused integration challenges, slowing time-to-market for new products and increasing manual processes.

- White Papers

According to statistic, the managed services market size is anticipated to increase at a compound annual growth rate (CAGR) of 13.6% from 2023 to 2030, reaching a value of USD 267.3 billion in 2022. The necessity for enterprises to save costs while maintaining high levels of service quality and the growing demand for cloud-based services are the key drivers of this expansion.

- Case Study

A multinational beauty company was facing difficulties in devising scientific method for forecasting and strategic planning. Visionet developed a accurate predictive forecasting pipeline accommodative of managing all data sources and external factors, lashed with capability to handle future challenges. The resulting forecasting pipelines enabled data-driven decision-making capabilities impacting product innovation, opening new markets, and supply chain planning.

- Case Study

Client

A leading organization utilizing Resware, an internal application for managing the closing process, document classification, and data management in a highly complex environment.

- Case Study

CPO, a leading U.S. tool retailer, sought Visionet’s expertise to create a more engaging and profitable online shopping experience through Salesforce technology.

- Case Study

Client

A leading fashion apparel brand sought to enhance its eCommerce presence by reinventing its sitewide user experience. Their outdated legacy email tools and inefficient marketing platforms hindered their ability to engage unique customer segments, personalize campaigns, and optimize digital performance, leading to increased integration costs and higher bounce rates.

- Case Study

Our client, a premium oilfield chemicals supplier, and energy-related services provider collaborated with Visionet to modernize its processes and upgrade from Dynamics AX 2012 to Dynamics 365. Find out how this digital transformation has enhanced their operational efficiency and ensured continued industry competitiveness.

- Case Study

Client

Our client is a global leader seeking to better govern and support its extensive field force across multiple countries.

- White Papers

The whitepaper is organized into several insightful sections, including:

- White Papers

However, adopting new sensor-based measurements is not straightforward in pharma and healthcare. Although Pharma executives recognize the importance of using sensors to capture patient data digitally, they face obstacles in embracing the technology due to the complexity of data platforms and the lack of bio-sensor platform engineering support. Regulations require that solutions be GxP compliant, which limits the IT consulting and engineering firms that pharma can work with.

- Event

In today’s digital landscape, customer expectations are higher than ever before. They demand seamless experiences across all touchpoints, with personalized interactions and the ability to buy products and services on their terms. Unfortunately, many brands are struggling to meet these expectations due to siloed data, disintegrated systems, and outdated technology.

- Case Study

Visionet enabled leading software solutions and services provider to overcome a lack of security governance and controls and audit delay, paving the way for standardized compliance, enhanced efficiency and productivity, and improved overall security posture.

- White Papers

The Impact of AI-powered Forecasting

The modern business world is volatile owing to rising competition, technological disruptions, and business model innovations. To mitigate uncertainty and remain competitive, organizations need to make prudent decisions. Forecasting enables keen insight into the future and is necessary for business decisions as diverse as inventory planning, production planning, capital expenditure allocation, workforce planning, etc.

- Blog

In today’s data-driven world, companies collect and store vast amounts of data. This data is often used to make important business decisions, perform predictive analysis, improve services, and create insights. However, if this data is not properly managed, it can lead to serious consequences such as data breaches, privacy violations, loss of trust in data, and sub-optimal decision-making.

- White Papers

This white paper provides a comprehensive guide to implementing a proactive approach to cybersecurity. With insights into the latest cybersecurity trends, threats, and best practices for protecting your business and customers, it is a must-read for any business owner or IT professional concerned about cybersecurity.

Through this white paper, you will:

- White Papers

Digitization is on the continuum of growth. Understanding how the modern economy will unfold is not simple anymore, as it is driven by the customers. Keeping up with their changing preferences is challenging, especially without the right tools and expertise.

- Case Study

Client

A leading home goods store chain was struggling with reduced ROI due to excess inventory caused by inaccurate demand forecasting. These inefficiencies in their supply chain were impacting profitability and operational agility, prompting the need for a next-gen forecasting solution.

- Ebooks

Having a Robust Data Foundation is Essential in Building a Digital Enterprise

Data Platform Modernization is an urgent need for organizations today as they grapple with managing an ever-increasing volume of data from multiple sources. The inability of traditional data platforms to keep up with the deluge of data from multiple sources is leaving organizations struggling to extract valuable insights.

- Case Study

The case study is about a multinational consumer goods company that operates globally and owns over 400 popular brands. Due to the size of its distribution network, the company was generating large volumes of raw data daily and struggled to track key performance indicators and track distributor performance.

- Case Study

Client

ICSC is the world’s leading trade association for the shopping center and retail real estate industry. With 70,000+ members in over 100 countries, ICSC hosts hundreds of events annually, connecting industry professionals through networking, insights, and business development opportunities.

- Case Study

Client

The client is a leading gold and diamond jewelry company with a legacy spanning over five decades. Operating approximately 100 showrooms across 72 cities and towns in India, the company is a prominent player in the jewelry retail industry. They aspired to create a unique and engaging shopping experience by leveraging augmented reality (AR) technology to enhance customer satisfaction and differentiate themselves in the competitive market.

- Brochure

The role of a data platform is becoming more and more crucial as organizations gather an ever-increasing volume of data from multiple internal and third-party sources. Data availability and reliability can become questionable, especially when managing data coming from multiple sources. Organizations are struggling with the inability of their data platforms to meet the required SLAs.

- Brochure

Is your business ready for the future of commerce?

In today’s fast-paced digital landscape, traditional e-commerce alone won’t keep you ahead. To stay competitive, businesses must embrace new channels that offer seamless, engaging, and personalized customer experiences. Discover how your brand can thrive by integrating social and conversational commerce into your strategy.

- Event

Visionet returns to the National Retail Federation Big Show this January in New York. Meet our experts to explore the strategies and technologies to transform your retail business from a connected commerce experience to a truly sustainable supply chain ecosystem.

Join us at booth #4062 at Level 3 and see how our retail industry cloud helps you deliver holistic digital experiences and a connected - Case Study

Client

The client is a leading online retailer in America, specializing in power tools and equipment for professional tradesmen and DIY enthusiasts. With 18 years of experience, they offer a wide range of tools, accessories, and supplies, both new and refurbished, from renowned brands. The company serves its customers via its website and eCommerce platforms like Amazon, ensuring seamless access to industry-leading equipment at affordable prices.

- Webinars

With the rise in online shopping, brands are finding more ways to create a human connection with consumers. And while it may seem contradictory to humanize an inherently digital experience, many retailers are succeeding at this. The answer to humanizing digital spaces lies in experiential commerce and personalization as part of a cohesive omnichannel framework. This puts the focus back on the customer and creates lasting impressions and brand loyalty.

- Case Study

On the lookout for a reliable data platform partner to help them deliver quality care and maximize patient satisfaction, a leading specialty pharmacy in Europe trusted Visionet’s Modern Data Platform. This collaboration allowed the brand to bridge the gaps in its healthcare system and offer personalized patient care with a 360° patient view.

- Case Study

How Visionet transformed actuarial IT for a fortune 500 firm with intelligent automation

Overcoming Obstacles in Your Actuarial IT Operations? Discover how Visionet helped a Fortune 500 company stabilize its IT environment, automate processes, and reduce costs—resulting in faster operations, improved reliability, and greater autonomy.

- News

November 6, 2020 – Technology consulting and services company Visionet Systems, Inc. participated in this year’s IFDA Digital Solutions Conference, organized for the first time as virtual event.

- White Papers

Patterns in Events: Aggregating Customer Journeys

As retail professionals, we understand the significance of data and the complexities of its exponential growth every day.

It is now imperative for retailers to store, organize, integrate, analyze, and activate this rich data to garner actionable insights — to retain existing customers and convert them into loyalists while attracting new customers.

- News

Visionet, premier technology solutions, and business process Management Company have launched Loangility – A complete Point-Of-Sale (POS) for Mortgage origination services built on Salesforce. Loangility POS for Salesforce provides a layer over your existing Salesforce CRM and extends a fully functional Mortgage CRM to the Salesforce Customer Relationship Manager.

- Brochure

As companies across the world continue to grapple with the ever-changing global business environment and the challenges of digital transformation to gain a competitive edge, the role of Digital Marketing and Branding has become more vital than ever. Businesses are now facing increased competition and one of the major things contributing to this competition is the ever changing consumer behavior.

- Case Study

Client

A leading European department store with over 40,000 daily visitors and 380,000+ products relied entirely on brick-and-mortar sales. With no digital presence, COVID-19 closures put its revenue at risk.

- Event